Why can’t the Minnesota Legislature give consumers a MinnesotaCare buy-in option so that they have a guaranteed health insurance coverage option, more doctor choices, and much better price competition? An army of corporate lobbyists say it’s because reimbursements to the health care industry would be lower under that approach, an argument that froze legislators into inaction during the 2019 legislative session.

To be clear, if that argument prevails, Minnesota lawmakers will never contain health care costs.

To contain costs, policymakers have to lower the amount of money going to the major cost drivers — insurance overhead, doctors, nurses, medical devices and pharmaceuticals. If politicians reject a reform every time lobbyists for those cost-drivers object about getting lower reimbursements, they will never contain consumer costs.

Let’s look at one of those cost-drivers, physicians. Politicians like to complain about insurance overhead and pharmaceuticals, for very good reasons, but that’s too easy. Let’s look at the most sacred of health care’s sacred cows. Doctors have an abundance of fans, campaign donating power, and lobbyists, so politicians are especially afraid to direct cost-control efforts at them.

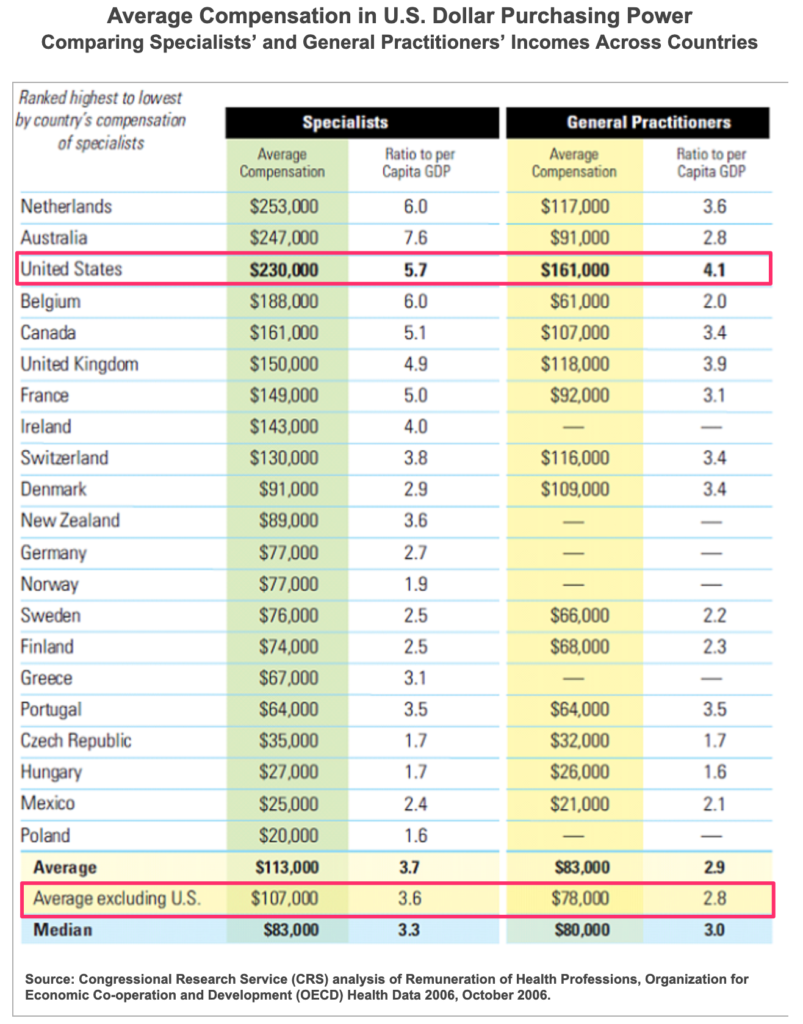

When you look at the long list of developed nations where physicians are paid less than in the U.S., paying less for doctors seems reasonable and doable. For example, the average specialist in the U.S. earns $230,000 per year, while the average specialist in other industrialized nations receives less than half that amount, $107,000 per year.

Remember that the next time you hear physicians and their lobbyists complaining about reimbursements being too low.

Oh and by the way, the health outcomes in those developed countries with modestly paid physicians are better than in the U.S. So don’t buy the claim or inference that better pay automatically leads to better care. It doesn’t.

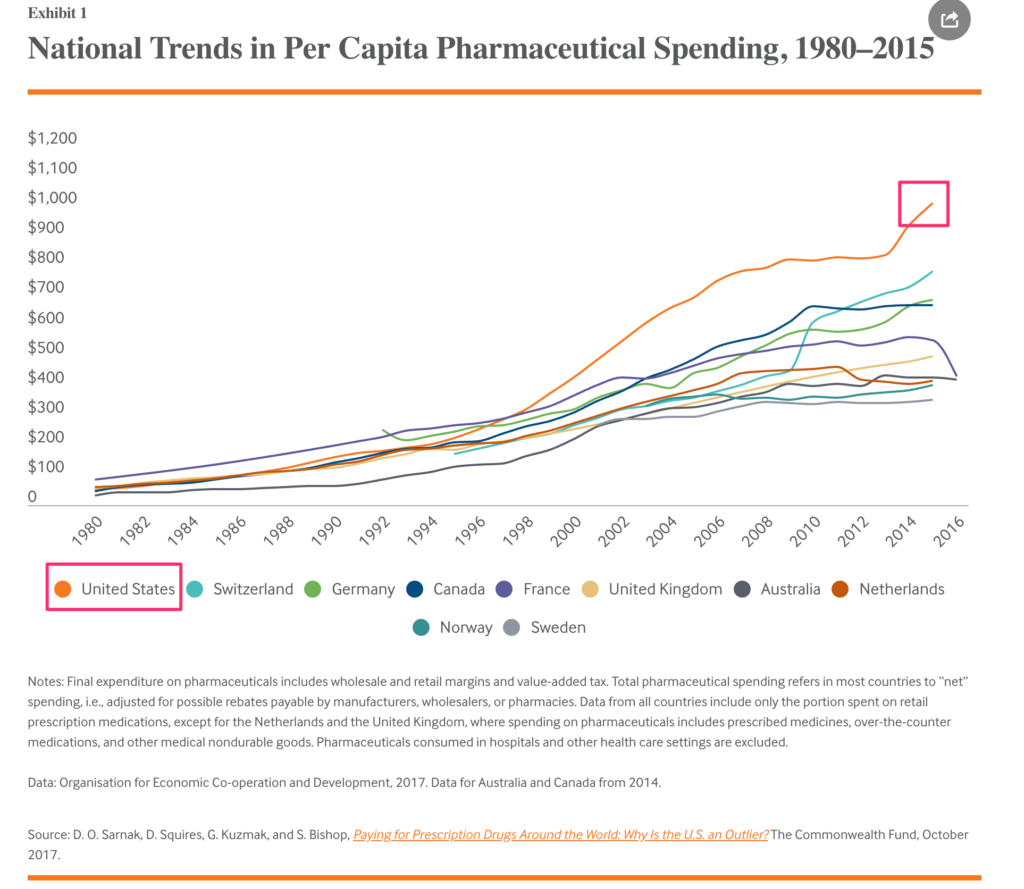

And about those pharmaceuticals. American patients pay much more for pharmaceuticals than patients in many other developed nations around the world. Remember that the next time you hear lobbyists complaining about Medicare and Medicaid reimbursements being too low.

(On this front, the Minnesota Legislature needs to pass legislation to allow importation of Canadian pharmaceuticals, as I argued a while back. Florida recently passed such a bill, but Minnesota politicians remain frozen by health care lobbyists.)

A Minnesota Care buy-in option — branded as “ONECare” in Minnesota by Governor Tim “One Minnesota™” Walz — would ensure that every Minnesotan always has at least one health insurance option available to them, which is particularly important in remote rural areas. It would give them broader networks of caregivers, which again is important to Greater Minnesota residents. It would provide comprehensive benefits and a service that gets good consumer reviews. It would bring better price competition to hold down the health insurance costs. Those all would be huge benefits for hundreds of thousands of Minnesotans.

But not if Minnesota politicians get cowed into inaction every time corporate health care industry lobbyists complain about receiving lower reimbursement rates. If this group of legislators won’t do the right thing on a MinnesotaCare buy-in option, we should elect a new group who will.

Today in its lead front page story, the Star Tribune trumpeted Governor Tim Walz as the triumphant victor in the recently concluded legislative session. But the truth is, the real victor looks more like conservative devotees of a “no new taxes” pledge.

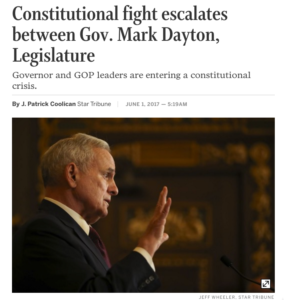

Today in its lead front page story, the Star Tribune trumpeted Governor Tim Walz as the triumphant victor in the recently concluded legislative session. But the truth is, the real victor looks more like conservative devotees of a “no new taxes” pledge. As we count down Mark Dayton’s final days as Governor of Minnesota, it’s worth reflecting on one of the more peculiar figures in recent Minnesota political history.

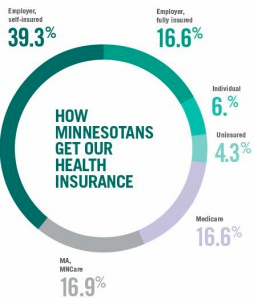

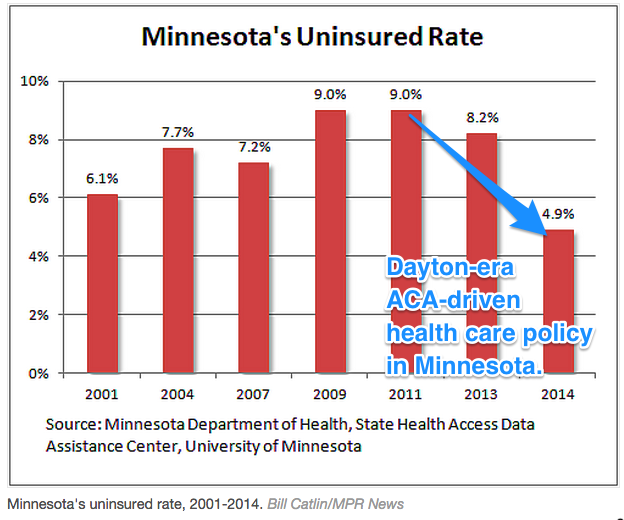

As we count down Mark Dayton’s final days as Governor of Minnesota, it’s worth reflecting on one of the more peculiar figures in recent Minnesota political history. Exuberant Minnesota Republicans seem to think they have a winning health care issue for the 2018 election season–reinsurance. And they do deserve a great deal of credit for helping to enact a state reinsurance program that is reducing premiums for Minnesotans in the individual market. The individual market is for the 162,000 Minnesotans who can’t get insurance from their employer or the government.

Exuberant Minnesota Republicans seem to think they have a winning health care issue for the 2018 election season–reinsurance. And they do deserve a great deal of credit for helping to enact a state reinsurance program that is reducing premiums for Minnesotans in the individual market. The individual market is for the 162,000 Minnesotans who can’t get insurance from their employer or the government. Who is that gallant knight

Who is that gallant knight  Saint Paul. MN — Ronald “Bud” Carlson, a 68-year old veteran of the Minnesota Senate (R-Lake City), desperately needed a new power tie for an American Legislative Exchange Council (ALEC) annual meeting at a Trump Hotel in Las Vegas last week. But he didn’t have the money to pay for the Stefano Ricci one he needed.

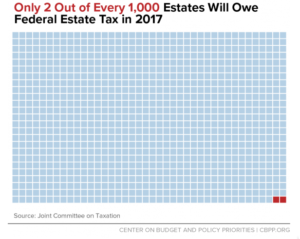

Saint Paul. MN — Ronald “Bud” Carlson, a 68-year old veteran of the Minnesota Senate (R-Lake City), desperately needed a new power tie for an American Legislative Exchange Council (ALEC) annual meeting at a Trump Hotel in Las Vegas last week. But he didn’t have the money to pay for the Stefano Ricci one he needed. In the first year that Minnesota Republicans took full control of the Minnesota Legislature, they elevated Minnesota’s millionaire heirs and heiresses to the very top of their fiscal priority list. Representative Greg Davids (R-Preston) says the wealthiest Minnesotans should be able to “keep more of what their mothers and fathers and grandfathers and grandmothers have earned,” so Republicans significantly increased the’ estate tax exemption for millionaires.

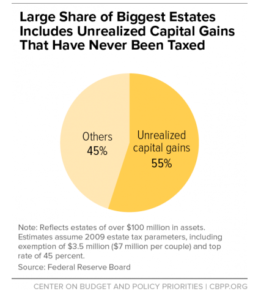

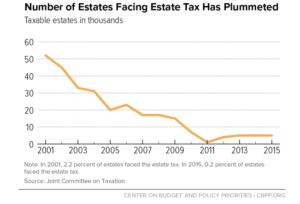

In the first year that Minnesota Republicans took full control of the Minnesota Legislature, they elevated Minnesota’s millionaire heirs and heiresses to the very top of their fiscal priority list. Representative Greg Davids (R-Preston) says the wealthiest Minnesotans should be able to “keep more of what their mothers and fathers and grandfathers and grandmothers have earned,” so Republicans significantly increased the’ estate tax exemption for millionaires. This is how intergenerational privilege perpetuates: Millionaire heirs and heiresses – having done nothing more than winning the birth lottery by being born into a wealthy family — are exempted from taxation, including for wealth that has already avoided taxation because it is

This is how intergenerational privilege perpetuates: Millionaire heirs and heiresses – having done nothing more than winning the birth lottery by being born into a wealthy family — are exempted from taxation, including for wealth that has already avoided taxation because it is  While today’s Republican Tea Partiers don Revolutionary War-era tri-corner hats while asserting that the estate tax is “Marxist,” the truth is that the estate tax has been strongly supported by a number of founding fathers.

While today’s Republican Tea Partiers don Revolutionary War-era tri-corner hats while asserting that the estate tax is “Marxist,” the truth is that the estate tax has been strongly supported by a number of founding fathers. In 2011, taxpayers gave billionaire Minnesota Vikings owner Zygmunt “Zygi” Wilf quite a gift, an even bigger gift than some realized at the time.

In 2011, taxpayers gave billionaire Minnesota Vikings owner Zygmunt “Zygi” Wilf quite a gift, an even bigger gift than some realized at the time.

Republicans — ever eager to show they are in touch with the values of ordinary Minnesotans — are very fond of drawing analogies between household budgeting and government budgeting. Former Governor Tim Pawlenty was especially keen on talking about the virtues of “kitchen table budgeting.”

Republicans — ever eager to show they are in touch with the values of ordinary Minnesotans — are very fond of drawing analogies between household budgeting and government budgeting. Former Governor Tim Pawlenty was especially keen on talking about the virtues of “kitchen table budgeting.” More to the point, families typically don’t cut the family budget — across the board or otherwise — when the family finances are stable or improving. I promise you, this is not heard at very many kitchen tables: “Okay sweetie, we’re financially comfortable and stable right now, but let’s cut the household budget deeply anyway!”

More to the point, families typically don’t cut the family budget — across the board or otherwise — when the family finances are stable or improving. I promise you, this is not heard at very many kitchen tables: “Okay sweetie, we’re financially comfortable and stable right now, but let’s cut the household budget deeply anyway!” Out on the campaign stump, Republicans say they want more health plan options than are currently available. They want health insurance companies to feel more competitive pressure to keep a lid on premiums. They want consumers to have a broad network of health care providers available to them. They want assurances that there will always be at least one solid coverage option available to every Minnesotan, even when health insurance companies decide to pull out of the marketplace, as they have in recent years. Those are all good goals.

Out on the campaign stump, Republicans say they want more health plan options than are currently available. They want health insurance companies to feel more competitive pressure to keep a lid on premiums. They want consumers to have a broad network of health care providers available to them. They want assurances that there will always be at least one solid coverage option available to every Minnesotan, even when health insurance companies decide to pull out of the marketplace, as they have in recent years. Those are all good goals. A steady stream of candidates for the 2018 gubernatorial race will soon be emerging. Often “past is prologue” in politics, so we might want to consider the type of leader Minnesotans have preferred in our recent past.

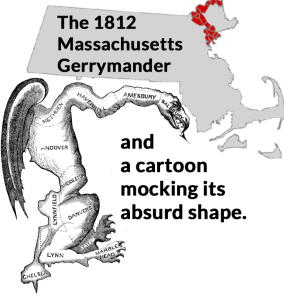

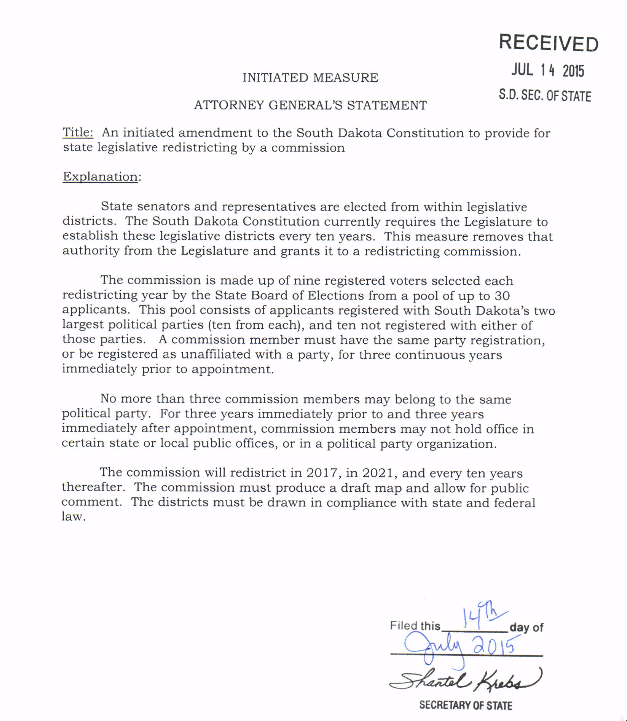

A steady stream of candidates for the 2018 gubernatorial race will soon be emerging. Often “past is prologue” in politics, so we might want to consider the type of leader Minnesotans have preferred in our recent past. Once every ten years, all states redraw state and congressional legislative district lines, so that the new boundaries reflect population changes that have occurred in the prior decade. In both Minnesota and South Dakota, elected state legislators draw those district map lines, and the decision-making is dominated by leaders of the party or parties in power.

Once every ten years, all states redraw state and congressional legislative district lines, so that the new boundaries reflect population changes that have occurred in the prior decade. In both Minnesota and South Dakota, elected state legislators draw those district map lines, and the decision-making is dominated by leaders of the party or parties in power. The basic rationale behind Amendment T is this: Elected officials have a direct stake in how those district boundaries are drawn, so giving them the power to draw the maps can easily lead to either the perception or reality of self-serving shenanigans.

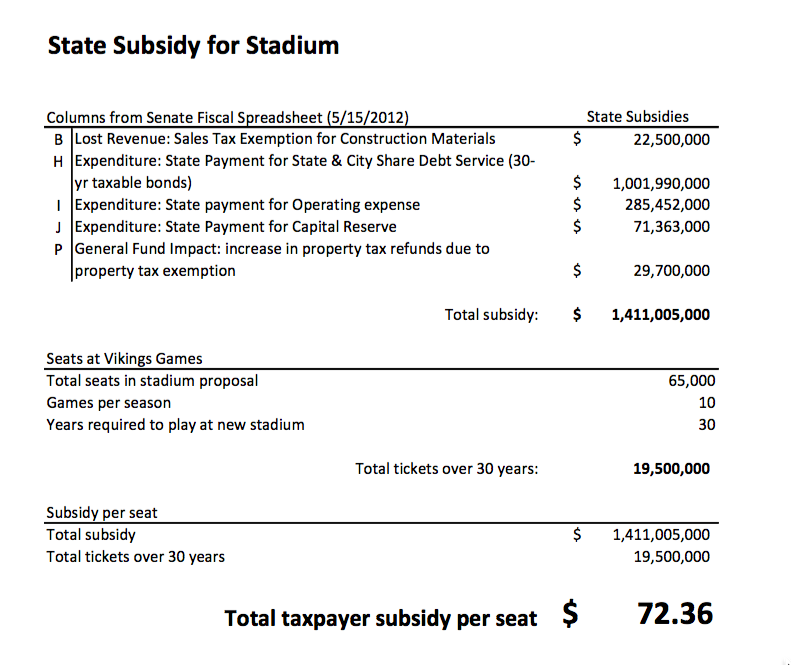

The basic rationale behind Amendment T is this: Elected officials have a direct stake in how those district boundaries are drawn, so giving them the power to draw the maps can easily lead to either the perception or reality of self-serving shenanigans. Are Minnesota Vikings season ticket holders effectively government-dependent welfare queens? After all, a state legislator’s analysis finds that every Vikings ticket benefits from a taxpayer subsidy of over $72.

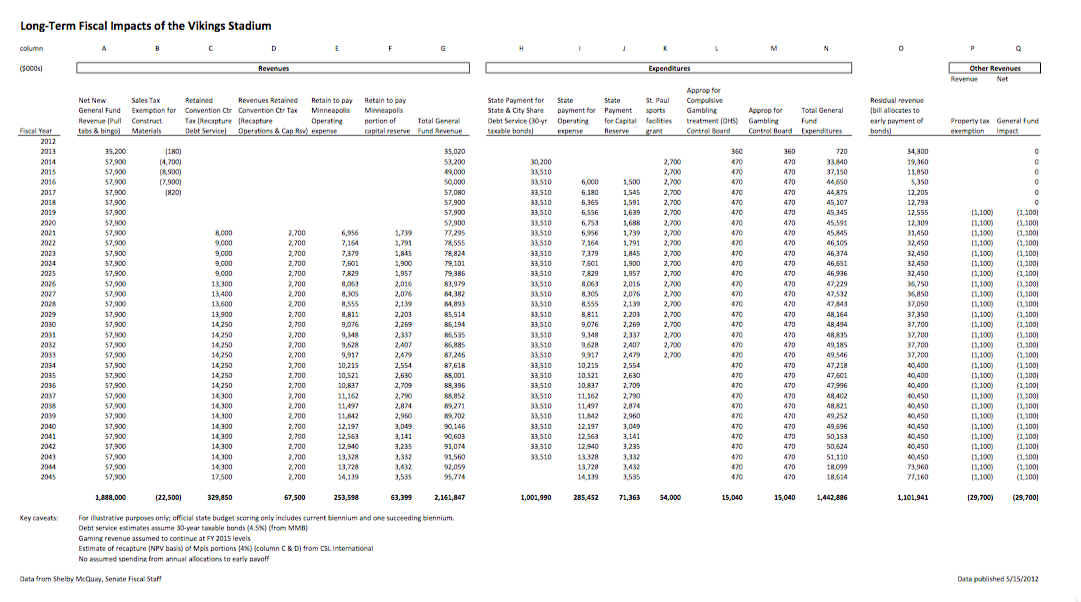

Are Minnesota Vikings season ticket holders effectively government-dependent welfare queens? After all, a state legislator’s analysis finds that every Vikings ticket benefits from a taxpayer subsidy of over $72. Critics may quibble with the specifics of the Marty analysis. But specifics aside, the undeniable fact remains that Minnesota taxpayers are on the hook for an enormous subsidy that looks to be much larger than the $498 million figure typically quoted during legislative debates.

Critics may quibble with the specifics of the Marty analysis. But specifics aside, the undeniable fact remains that Minnesota taxpayers are on the hook for an enormous subsidy that looks to be much larger than the $498 million figure typically quoted during legislative debates.

Governor Dayton has been very clear that early education investment is his Administration’s top priority. But you’d never know it by looking at the budget proposals coming out of the Minnesota Legislature so far this year.

Governor Dayton has been very clear that early education investment is his Administration’s top priority. But you’d never know it by looking at the budget proposals coming out of the Minnesota Legislature so far this year.

Oh and then there was that super nonpartisan time when Governor Pawlenty, who was preparing to run against President Obama, enacted an executive order to

Oh and then there was that super nonpartisan time when Governor Pawlenty, who was preparing to run against President Obama, enacted an executive order to

DFL state legislators are an awfully unpopular bunch. According to an August 2015 Public Policy Polling (PPP)

DFL state legislators are an awfully unpopular bunch. According to an August 2015 Public Policy Polling (PPP)

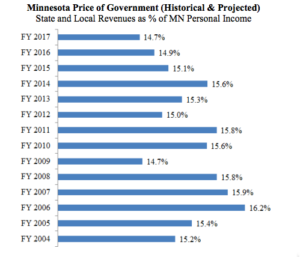

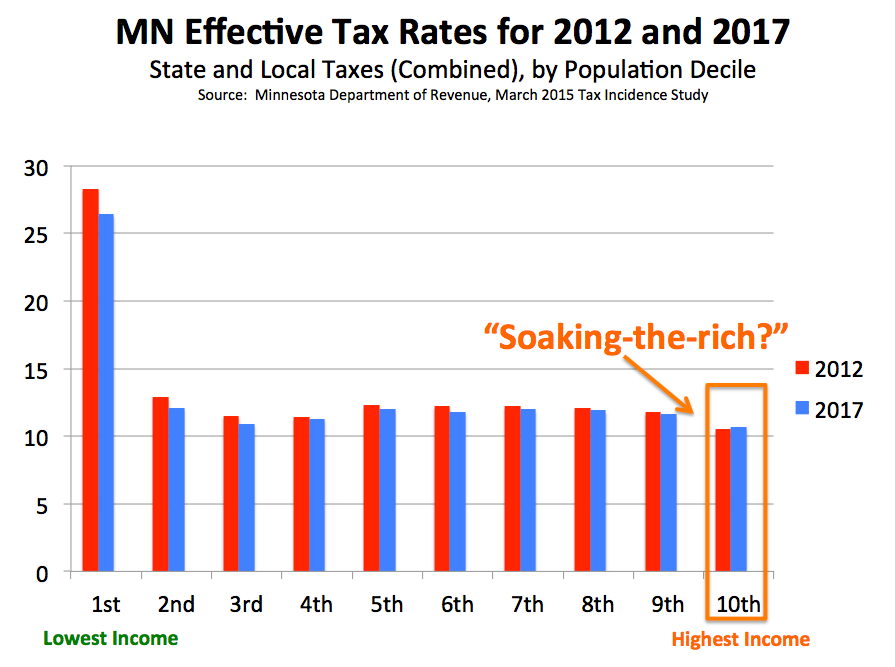

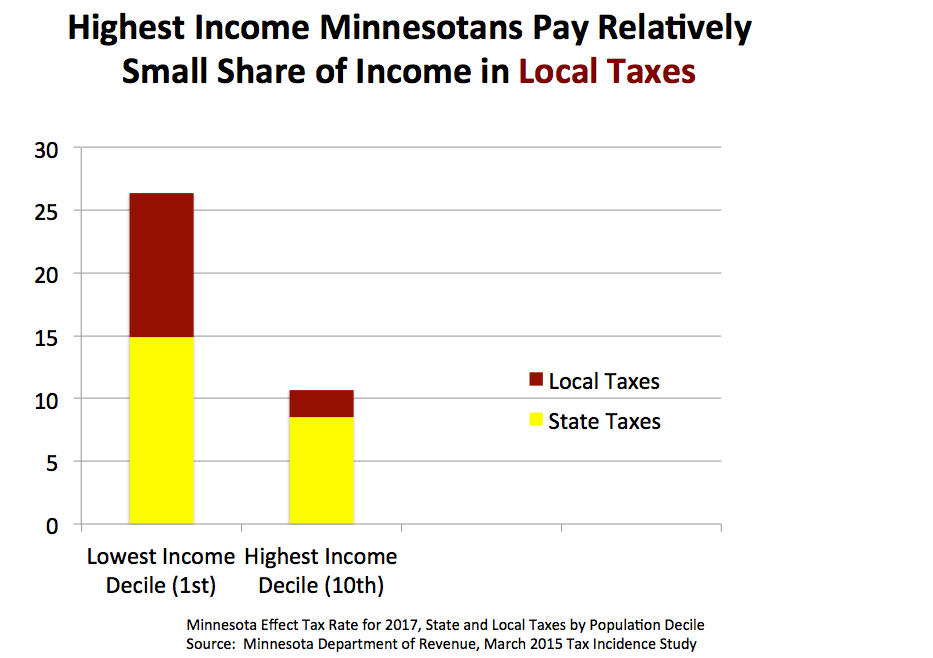

This is a point that is frequently missed, or intentionally ignored, by people who focus solely on state tax burdens, without also taking local tax burdens into consideration.

This is a point that is frequently missed, or intentionally ignored, by people who focus solely on state tax burdens, without also taking local tax burdens into consideration.