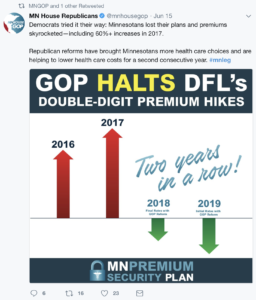

Exuberant Minnesota Republicans seem to think they have a winning health care issue for the 2018 election season–reinsurance. And they do deserve a great deal of credit for helping to enact a state reinsurance program that is reducing premiums for Minnesotans in the individual market. The individual market is for the 162,000 Minnesotans who can’t get insurance from their employer or the government.

Exuberant Minnesota Republicans seem to think they have a winning health care issue for the 2018 election season–reinsurance. And they do deserve a great deal of credit for helping to enact a state reinsurance program that is reducing premiums for Minnesotans in the individual market. The individual market is for the 162,000 Minnesotans who can’t get insurance from their employer or the government.

While their claim that premium increases in 2016 and 2017 were due to DFL policies is ridiculous, it is true that the Minnesota reinsurance program they helped pass is helping those consumers. As the Star Tribune reported:

Jim McManus, a Blue Cross spokesman, said that were it not for the state’s reinsurance program, the carrier’s Blue Plus HMO would be seeking an average individual market premium increase of 4.8 percent as opposed to the 11.8 percent decrease cited Friday by Commerce

Impressive, and Republicans deserve credit for this.

The Rest of the Story

But as Ricky Ricardo would say, before Minnesota Republicans can credibly brand themselves health coverage saviors, they still have some splainin to do.

Why Not National Reinsurance? First, they need to explain why their party – in complete control of the U.S. Senate, U.S. House and the Presidency and entire U.S. Executive Branch of the federal government – doesn’t enact reinsurance to help all Americans. Because of economies of scale and the need for market consistency, a national reinsurance program makes much more sense than a hodgepodge of variable state programs.

Moreover, if stabilizing the market and helping consumers pay less is good for Minnesotans, wouldn’t it be even more awesome to do that for all Americans? That’s likely why 75% of Americans support enacting reinsurance at the national level.

Why Sabotage the ACA? So why aren’t Rep. Erik Paulsen, Rep. Jason Lewis, Rep. Tom Emmer, Jeff Johnson or former Governor Tim Pawlenty pressing for reinsurance at a national level? Because they and their White House puppet master would rather sabotage the remarkably effective Affordable Care Act (ACA) than improve the ACA to help American families.

The list of things Trump and his congressional Trumpbulicans are doing to irresponsibly sabotage American families benefiting from ACA protections is long and breathtakingly irresponsible. This is hurting tens of millions of struggling Americans. Republicans are ignoring the 71% of Americans who say the Administration should do all it can to make the the ACA work, compared to just 21% who support efforts to make the ACA fail and replace it later.

Why Oppose Adding A MinnesotaCare Buy-in Option? The other thing Republicans boasting about the state reinsurance bill need to explain is this: Why aren’t they supporting giving the 162,000 Minnesotans in the individual market a MinnesotaCare buy-in option?

The MinnesotaCare buy-in option would achieve much of what Republicans profess to support — more plan and doctor choices for consumers in sparsely populated areas, guaranteed coverage for all Minnesotans in sparsely populated areas, and more competition to control prices.

The fact that Minnesota Republicans won’t support the common sensical MinnesotaCare buy-in option proposal, won’t push for a national reinsurance program, and continue to actively sabotage the ACA makes their gloating about being health care saviors ring very hollow.

Yesterday, Minnesota House Republicans–following the lead of President Trump and congressional supporters like Representatives Lewis, Emmer and Paulsen–

Yesterday, Minnesota House Republicans–following the lead of President Trump and congressional supporters like Representatives Lewis, Emmer and Paulsen– This week, statewide coverage

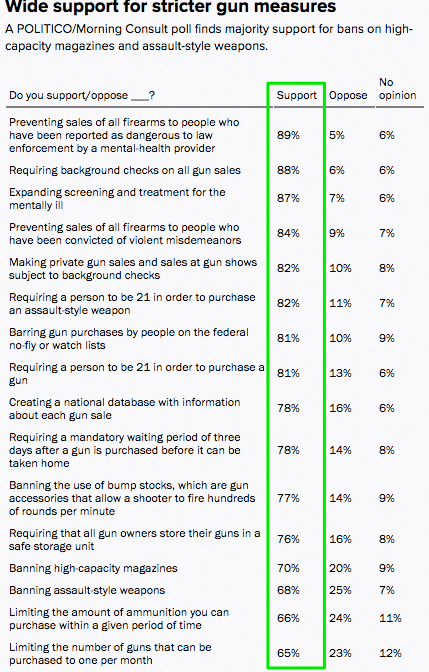

This week, statewide coverage  PUTTING NRA CONTRIBUTIONS OVER COMMON SENSE GUN PROTECTIONS. They have blocked

PUTTING NRA CONTRIBUTIONS OVER COMMON SENSE GUN PROTECTIONS. They have blocked