Minnesota Republicans think they have found a golden issue to run on in 2024. In the 2022 elections, campaigning on interfering with women’s healthcare decisions, blocking gun protections, banning books, censoring teachers, and championing insurrectionists didn’t go that great for them. Therefore, Republicans have settled on an old reliable “bread and butter” issue — fighting to cut taxes for the wealthiest individuals and corporations.

Bam! Take that, big-taxing progressives. Here come the trickle-down “Reagan Republicans.”

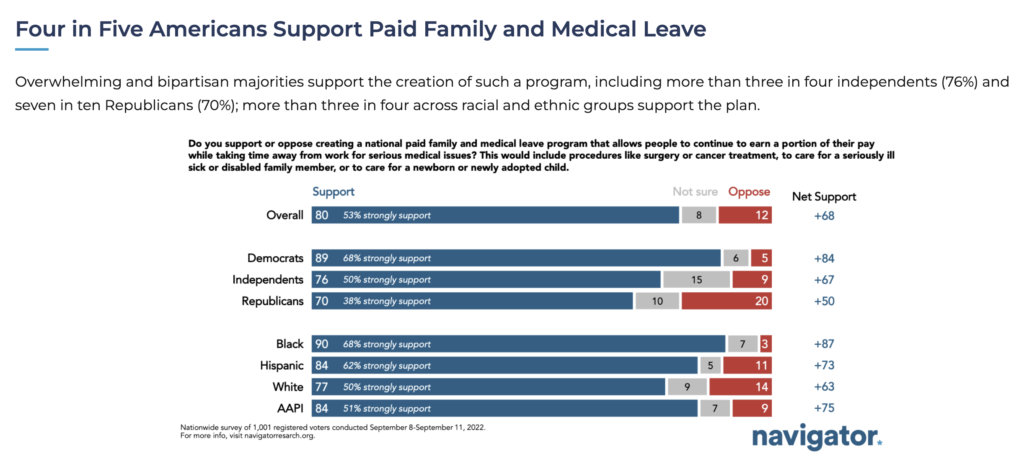

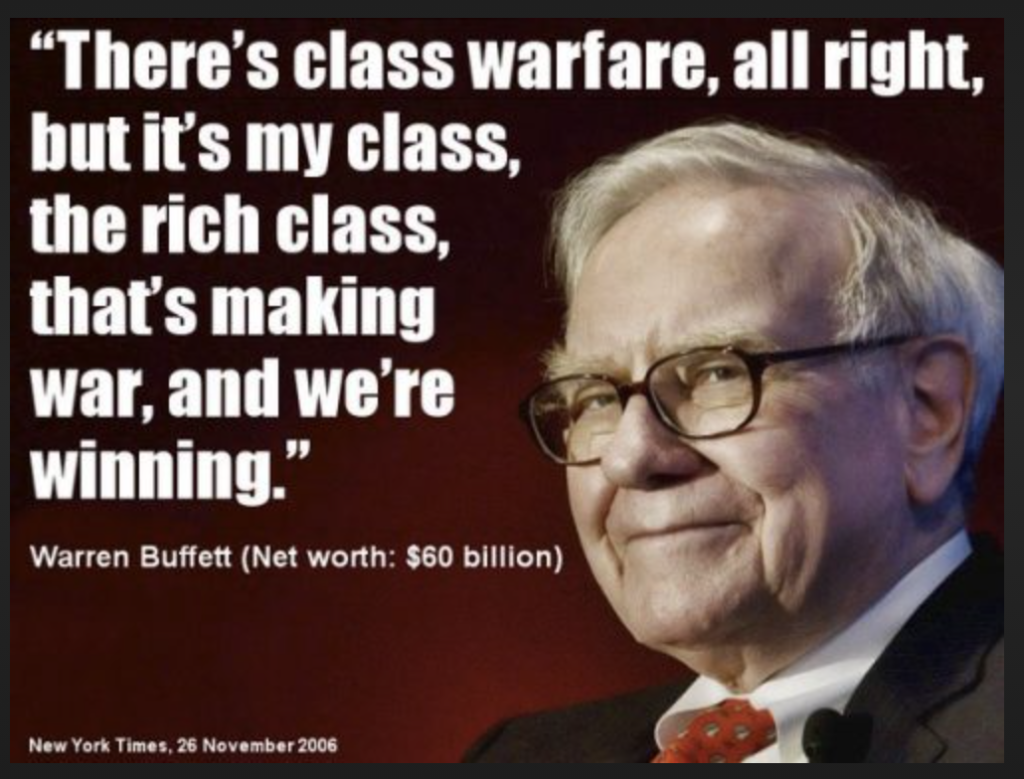

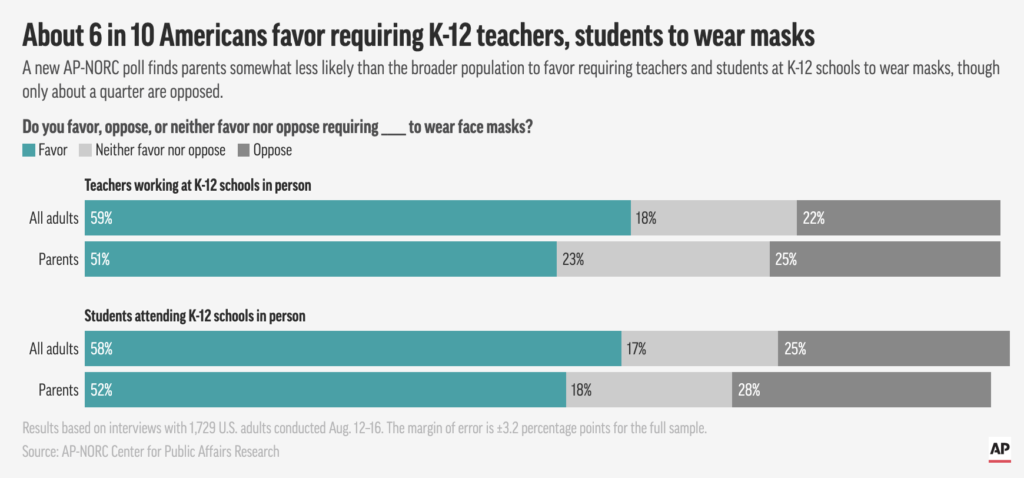

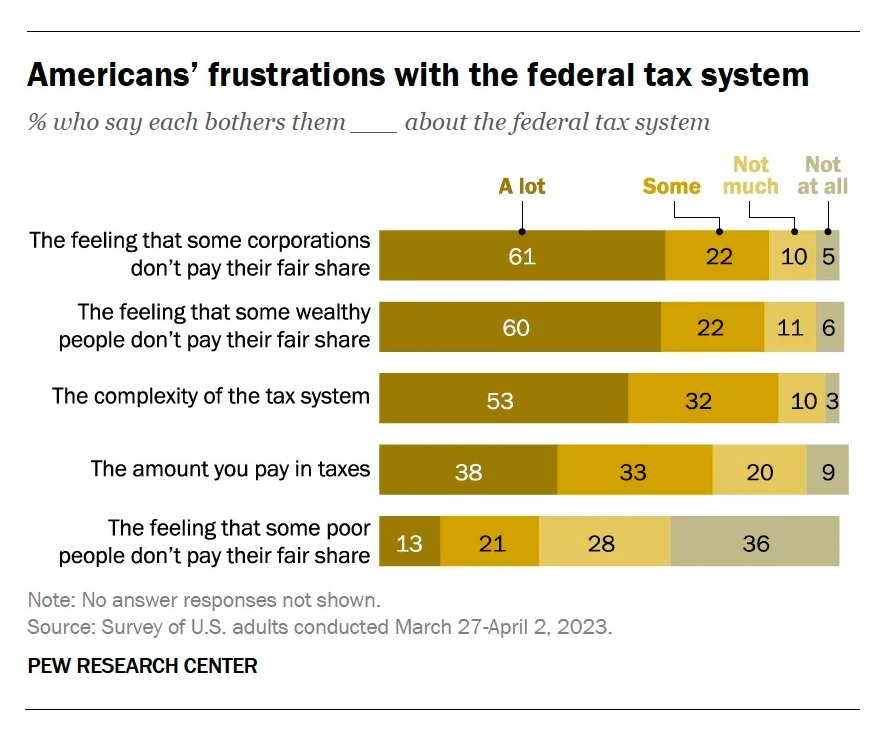

The problem is that this isn’t 1984, and most Americans do not want the wealthiest and corporations to have lower taxes. According to a March 2023 Pew survey, a jaw-dropping 83% of Americans are bothered — 61% “a lot,” 22% “somewhat” — that “some corporations don’t pay their fair share of taxes.” A nearly identical number are bothered that “some wealthy people don’t pay their fair share.” Only 17% agree with Republicans on that issue.

Looking at these numbers, you would be hard-pressed to find a worse issue for Republicans to emphasize during the 2024 elections. DFLer activists should consider contributing to Republicans who are paying to put their “shame on the DFL for taxing the wealthy and corporations” messages in front of voters. That messaging does Republicans much more harm than good.

If only Minnesota DFLers had a way to show the swing voters who will decide close races how they are fighting to ensure that wealthy people pay their fair share of taxes to support state infrastructure and services.

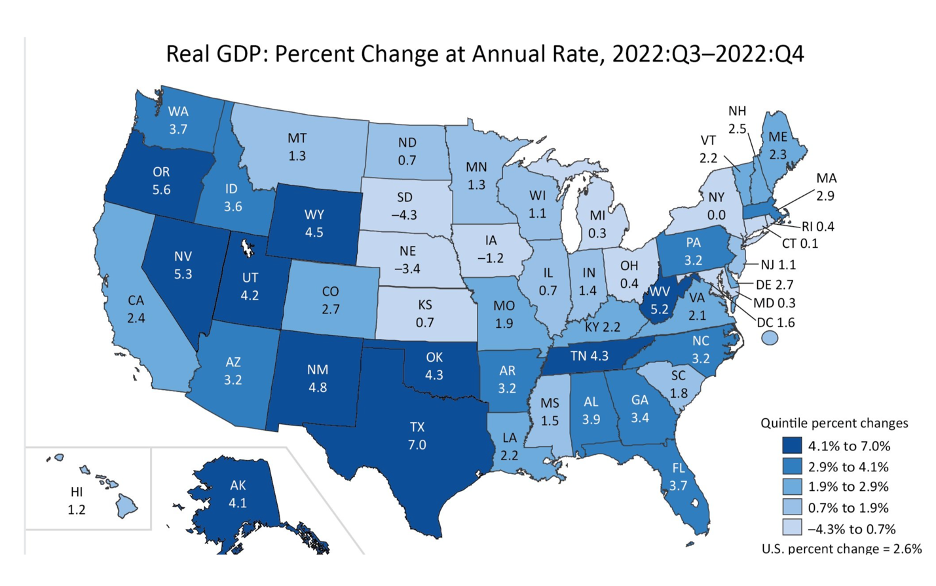

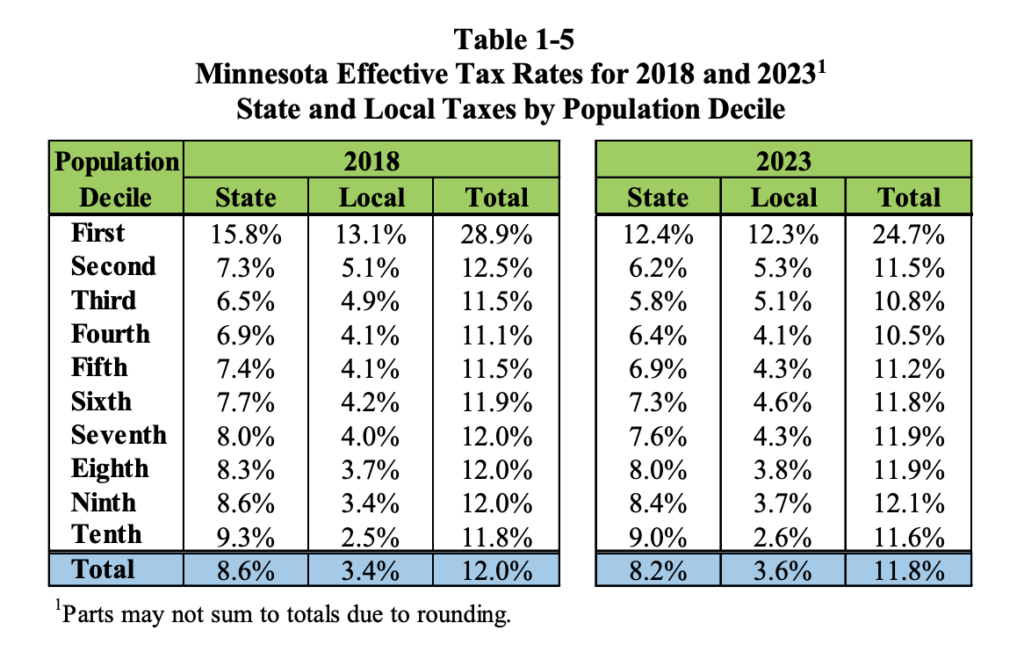

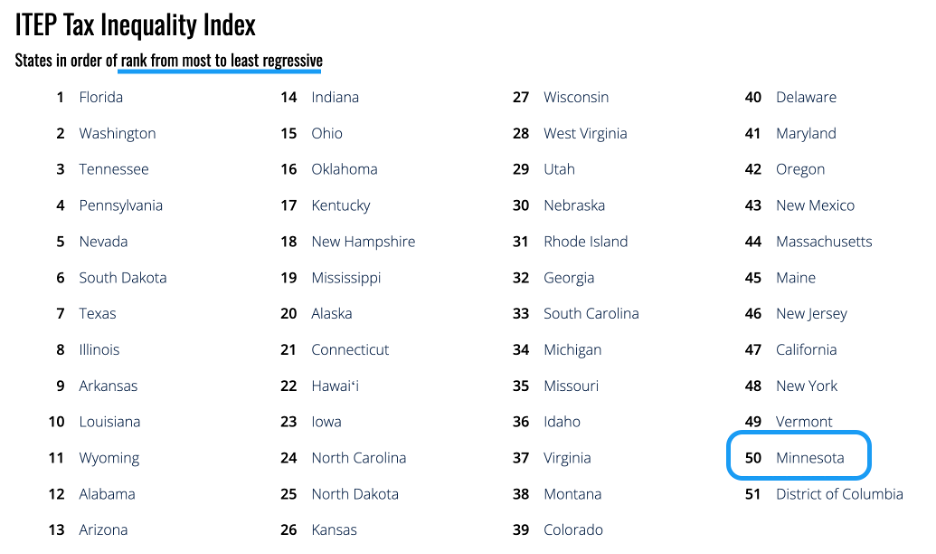

Enter the Institute on Taxation and Economic Policy (ITEP). The national think tank recently found that Minnesota currently has the #1 most equitable state and local tax system, thanks to changes made by DFLers.

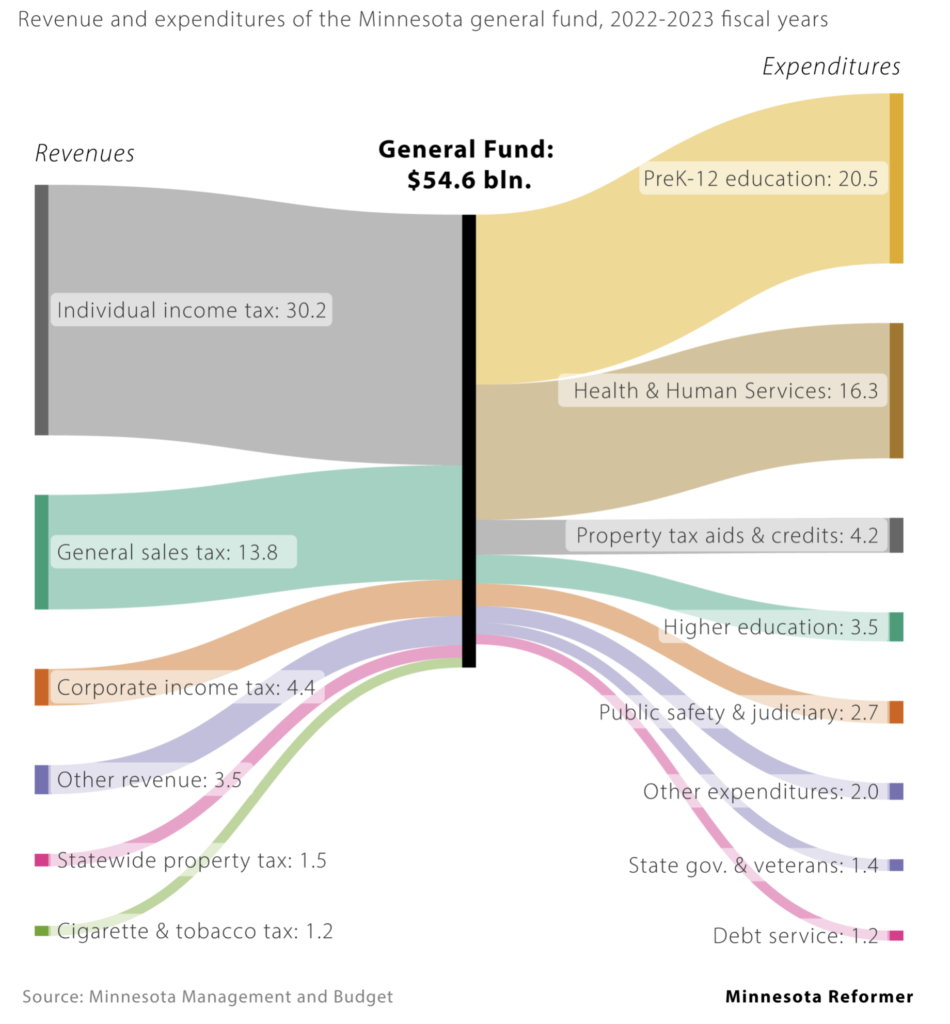

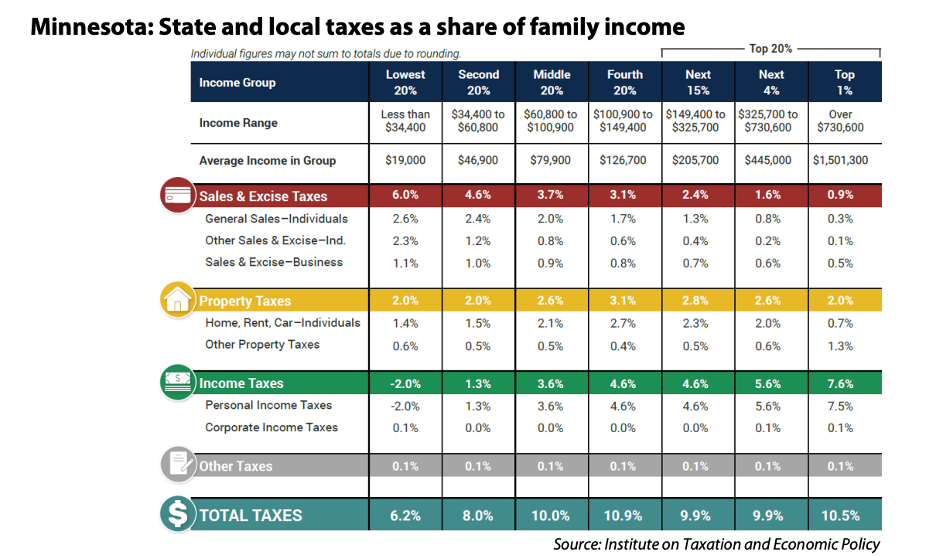

How does Minnesota have a more equitable system than other states? The breakdown for Minnesota by the Minnesota Budget Project shows that Minnesota’s highly progressive state income tax offsets out highly regressive sales and excise (e.g. alcohol, tobacco, gasoline) taxes.

You may recall, that in 2020 GOP gubernatorial candidate Scott Jensen and his followers ran on eliminating that state income tax. That 2020 election didn’t go particularly well for Johson and his party.

Based on the polling and Jensen’s shellacking, shouldn’t Minnesota’s tax fairness ranking be something that DFLers tout to the 83% who agree with them? Shouldn’t they “go on offense” on this issue?