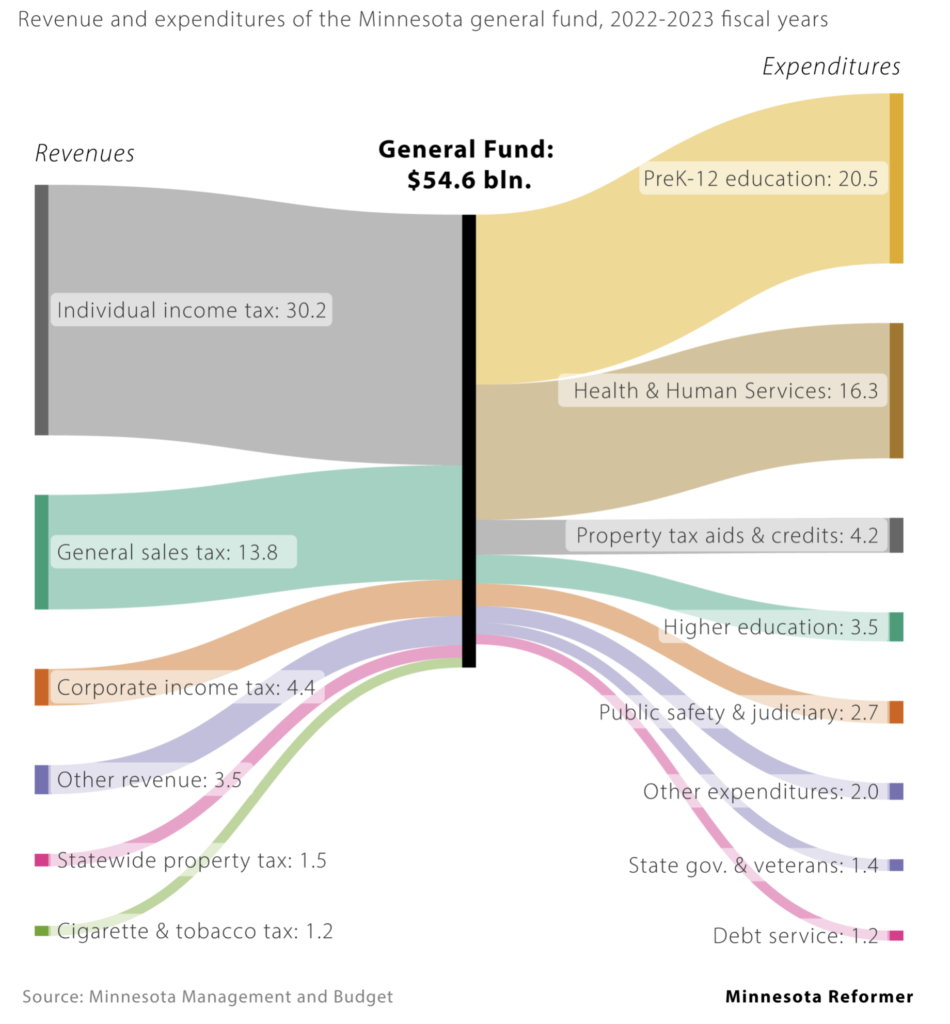

Minnesota Republican gubernatorial candidate Scott Jensen proposes to eliminate the state income tax. At first blush, that might sound good to inflation-weary taxpayers. But to balance the state budget, such a change would necessitate $15 billion per year in service cuts and/or increases in other types of more regressive taxes.

Quite irresponsibly, Jensen won’t say what services he would cut, or what taxes he would increase, to balance the state budget. But make no mistake, serious pain would result. Jensen’s plan would necessitate massive cuts in education and/or health care, and/or a huge increase in property taxes, or other types of taxes that are more regressive than the state income tax.

Shifting from the progressive state income tax to the regressive property tax is popular among the wealthiest Minnesotans, because that change would greatly benefit them. The progressive state income tax requires that the wealthiest Minnesotans pay a higher share of their income in taxes than is paid by the poorest Minnesotans. On the other hand, regressive property, sales, and/or excise taxes put more of a burden on lower-income Minnesotans compared to the wealthiest Minnesotans.

Wealthy doctors like Jensen, multi-millionaire professional athletes like his running mate Matt Birk, and the most financially privileged Minnesotans who disproportionately fund Republican candidates don’t want to pay their fair share in taxes. This is a political payoff to them.

Jensen’s proposal not only is a grossly inequitable giveaway to the wealthiest Minnesotans, it’s also dishonest. Jensen only discloses the benefits – no more income tax bill! – without disclosing the costs – crippling school cutbacks, slashed health care services for vulnerable Minnesotans, and/or crushing property tax increases. All of those costs are enormously unpopular with Minnesotans, so Scott Jensen simply refuses to answer that critical $15,000,000,0000 question.

Jensen isn’t explaining the downside of eliminating the state income tax, but reporters should be doing that. Unfortunately, it’s barely happening. Compared to heavy front page reporting on Walz’s actions related to a nonprofit fraud prosecution and the debate over the number of debates, this hugely consequential policy proposal has received relatively scant coverage.

One exception is the Minnesota Reformer. Though the Reformer has relatively light readership, it has done thoughtful and constructive reporting, such as this:

“Minnesota has a steeply progressive individual income tax, meaning households with higher incomes have a higher tax rate as a share of their income compared to lower income households. Eliminating individual income taxes would disproportionately burden low-income Minnesotans while giving huge tax cuts to the state’s wealthiest.

‘Progressive income taxes are integral to having budgets that can meet the needs of all citizens, and they’re also really important in ensuring racial and socioeconomic equity,’ said Neva Buktus, state policy analyst for the Institute on Taxation and Economic Policy. ‘Eliminating the personal income tax would completely throw that out the window.’

Each year, the Institute on Taxation and Economic Policy creates a ranking of state tax systems and how they foster income inequality.

The six least equitable in the U.S. are among the nine states with no individual income taxes. Minnesota’s progressive personal income tax makes it one of the least regressive in the country — 47th out of 50. That means our lowest income earners get a better deal than nearly every other American when it comes to state and local taxes.

‘If you’re going to eliminate the income tax, there’s no way to spin it. It disproportionately benefits the wealthiest Minnesotans by a long shot,’ Buktus said.”

At other major news outlets, my best guess is that reporters are shrugging off the issue relative to other issues because they believe that elimination of the state income tax could never pass the Legislature.

It’s not reporters’ jobs to gauge likelihood of passage. After all, no one knows what the future makeup of the Legislature might be if voters sweep Republicans into office, as historical trends portend. Instead, reporters are supposed to explain the candidates’ major policy proposals and analyze the consequences so voters can make fully informed decisions.

That’s just not happening as much as it should. Whatever the thinking in Twin Cities newsrooms about Jensen’s most radical and reckless policy proposal, their silence on the topic has been deafening.

President Donald Trump is coming to Minnesota today. That means we’ll be treated to lots of bullying of Representative Ilhan Omar, crowing about the “exoneration” that the Special Counsel specifically has said was not an exoneration, and vilifying of families fleeing desperate conditions for a better life in America.

President Donald Trump is coming to Minnesota today. That means we’ll be treated to lots of bullying of Representative Ilhan Omar, crowing about the “exoneration” that the Special Counsel specifically has said was not an exoneration, and vilifying of families fleeing desperate conditions for a better life in America.