This past winter and spring, the DFL-controlled state House, Senate, and Executive branch produced much more for ordinary families than Republicans ever did when they were in power. It’s not close.

As a result, things are getting heady for Walz and DFL legislators. To cite just one example of the national acclaim they’re getting, Washington Post columnist E.J. Dionne recently lavished praise on the Minnesota DFL’s 2023 legislative tour de force with a sloppy wet kiss of a column.

“The avalanche of progressive legislation that the state’s two-vote Democratic majority in the Minnesota House and one-vote advantage in the state Senate have enacted this year is a wonder to behold.

It’s no wonder former president Barack Obama tweeted recently: ‘If you need a reminder that elections have consequences, check out what’s happening in Minnesota.’

Democrats in the state are known as the Democratic-Farmer-Labor Party from their merger with a third party in the 1940s. True to the name, the party’s agenda combined social concerns such as abortion rights with what Long called “bread-and-butter, populist things that sell everywhere in the state.”

Well, E.J., thanks to the rural-urban division that the Minnesota Republican Party relentlessly promotes on the campaign trail, the DFL achievements don’t actually sell well “everywhere” in the state. According to an early May 2023 KSTP-TV/Survey USA poll, Walz still has much lower approval ratings in rural parts of the state (51% in the southern region, 42% in the western region, and 46% in the northeastern region) than he has in the Twin Cities seven-county metropolitan area (60% approval).

Still, Governor Walz’s 2023 performance is selling relatively well statewide. He has the approval of 54% of Minnesotans, compared to the disapproval of 41%. In a purple state that Trump only lost by 1.5 points in 2016, Walz’s 13-point net positive approval rating is impressive. Progressivism is selling pretty well in this purple state.

However, the political debate is just heating up. We can expect Republicans campaigning in 2026 to focus on the unpopular, vague notion of “government spending increases,” rather than the DFL’s specific policy changes. After all, polls show that individual DFL-enacted achievements are popular. For instance, 80% of Americans support paid family and medical leave, 80% of Americans support more child care assistance for families, 76% of Minnesotans support universal background checks for gun purchases, and 69% of Americans support more school funding, to name just a few of the many popular policies that DFLers passed during the 2023 session. Therefore, Republicans will focus on how much more the DFL-controlled state government is spending, not the DFL’s signature policy achievements.

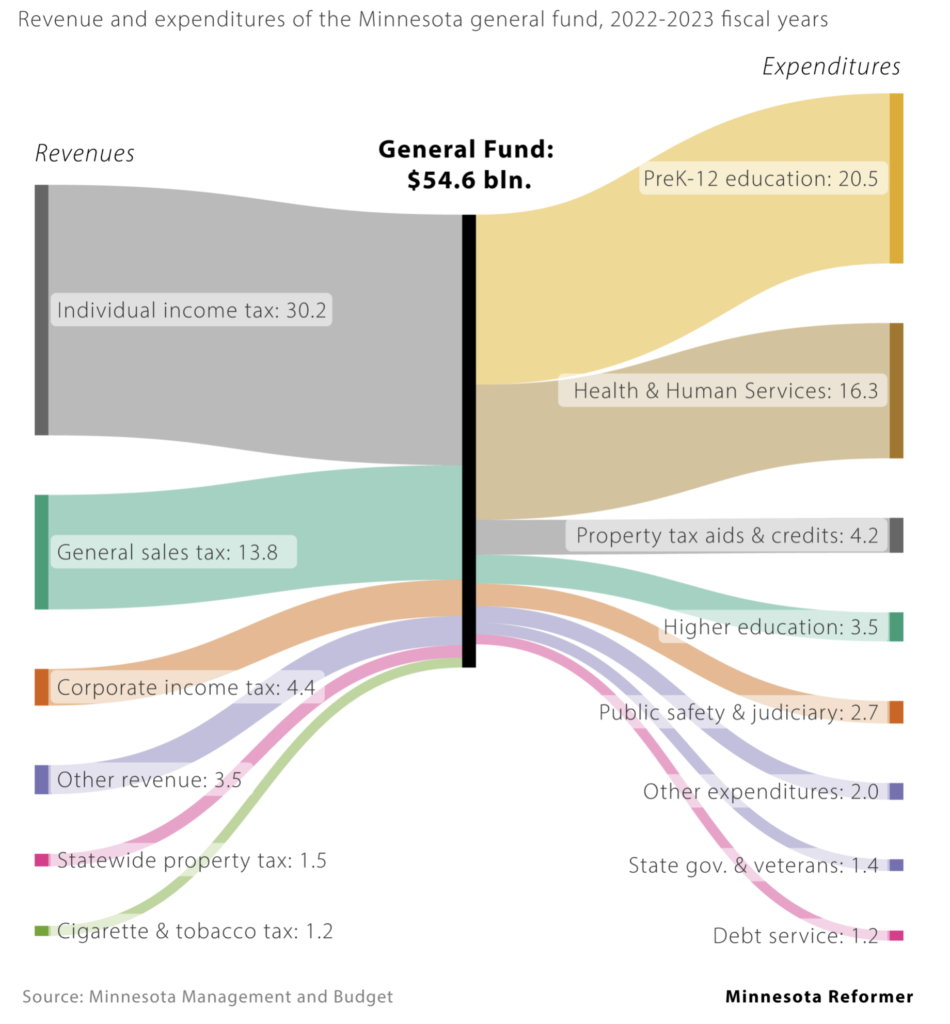

It is true that the state budget is increasing under DFLers in 2024. But is state government spending really that high?

According to usgovernmentspending.com, state spending in Minnesota in 2024 will be 10.15% of the state’s GDP, making it a middling 25th among the 50 states. Yawn.

So, sure, our Republican-controlled “race-to-the-bottom” neighbors in Iowa (9.87% of GDP), Wisconsin (9.64% of GDP), North Dakota (9.08% of GDP), and South Dakota (8.12% of GDP) are spending less than in Minnesota. No surprise there.

But state spending in Minnesota is nothing like what is happening annually in the top ten states of New Mexico (17.64%), Alaska (16.96%), West Virginia (16.42%), Vermont (16.12%), Hawaii (15.88%), Kentucky (15.18), Oregon (15.14%), Mississippi (14.94%), Louisiana (13.78%), and Maine (13.51%).

Despite Minnesota Republicans’ red-faced hyperbole about the DFL’s “out of control spending,” in a national context Minnesota is, meh, just average.