U.S. Rep. Dean Phillips (DFL-Edina) seems to be relishing the national attention that comes with his months of hemming and hawing about a long-shot potential challenge of Joe Biden for the Democratic presidential nomination. To be clear, Phillips is far from the best Democrat in the nation to serve as an alternative to Joe Biden. In fact, Phillips is not even close to being the best presidential candidate in little old Minnesota.

Phillips is fine. The former CEO of Phillips Distributing, his step-father’s inherited business, is thoughtful and decent, if also sometimes dull and self-righteous, as centrist politicicans tend to be. His bipartisan instincts have made him a good fit to represent the purple-ish 3rd congressional district, which is anchored by Minnesota’s most affluent western suburbs.

However, it’s time for Phillips to come out of the TV studios and return to representing his district. As Rep. Annie Kuster (D-NH) said in today’s Star Tribune:

There’s no path. There’s no outcry. Personally, I think it’s a vanity project by Mr. Phillips, and I think it could do serious damage by emboldening the Trump Republicans.”

To be clear, the most talented politician in Minnesota isn’t Phillips. It’s DFL Senator Amy Klobuchar, and it’s not even close. Reports about Klobuchar’s erratic behind-the-scenes behavior are concerning when it comes to the world’s most pressure-packed job. Still, no Minnesota politician is better than Klobuchar at doing what presidential candidates must do well – sell progressive ideas and positions in both wholesale and retail settings to a wide variety of audiences. Whether on big or small stages, Klobuchar consistently comes across as warm, sincere, tough, bright, thoughtful, prepared, nimble, and persuasive. As such, Minnesota’s senior senator would be a much more compelling presidential candidate than Phillips.

While Klobuchar is Minnesota’s most skilled politician, DFL Governor Tim Walz ranks second. At the same time, Walz has more marketable policy accomplishments than Kloubachar or any other Minnesota pol.

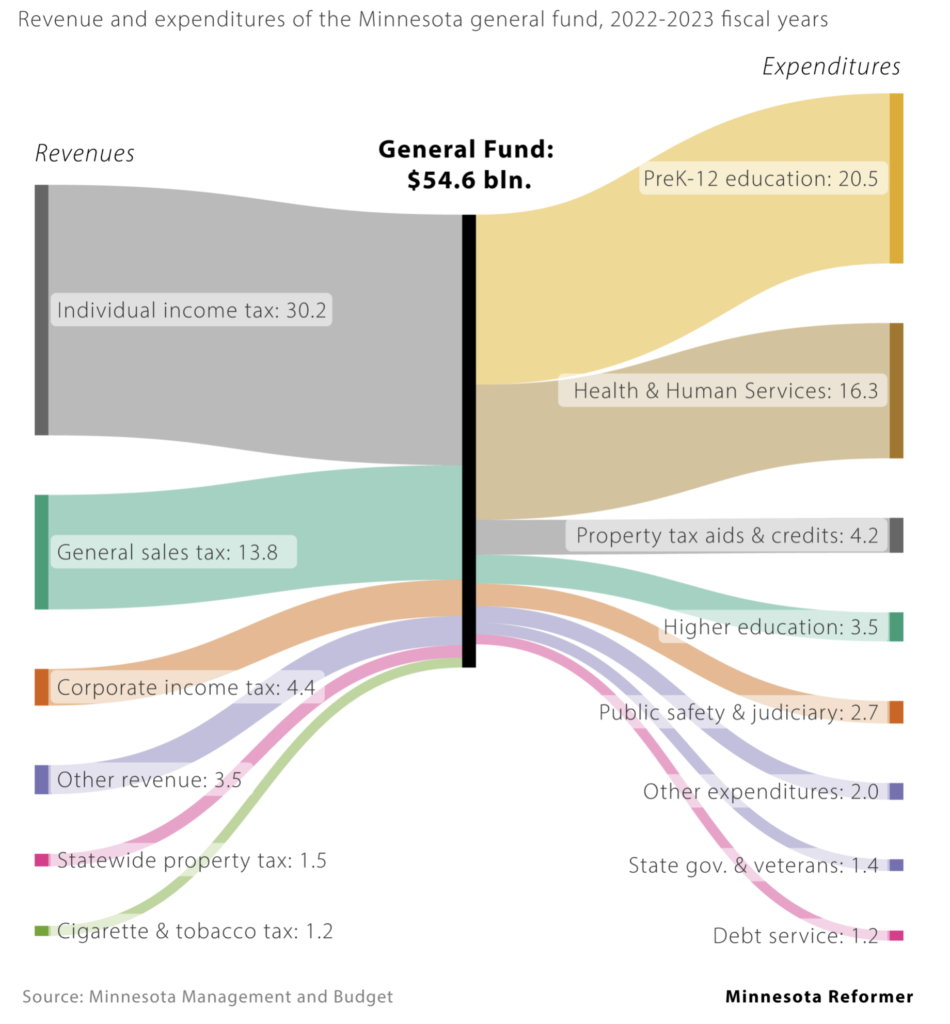

In a purple state with a slim one-vote DFL advantage in the state Senate, Walz can boast on national stages that he signed many state laws that national Democrats want to see on a national level, such as legislation creating a family and medical leave system, securing abortion rights, legalizing marijuana, expanding child care access, creating new gun violence protections, making voting more accessible, providing free school lunches for all, investing much more in public education, building a public option for health insurance, and requiring disclosure for dark money donors.

All the while, the Minnesota economy has outpaced a relatively strong national economy, with a lower rate of inflation and unemployment than the nation as a whole.

Walz’s long list of significant policy accomplishments would be popular among the national Democrats he would need to win over in a primary challenge against Biden. Importantly, it also would be popular among the swing voters a Democratic nominee will need to win over in a 2024 presidential general election. Politically speaking, Walz is well poised to make a “we will do for America what we did for Minnesota” pitch to Democrats clutching their pearls about Biden’s electoral viability.

State Capitol insiders are quick to point out that Walz’s myriad policy wins had more to do with House Speaker Melissa Hortman, Senate Majority Leader Kari Dziedzic, and a number of very capable DFLers chairing key committees. But that kind of inside baseball would largely be ignored by national pundits and reporters if Walz ran for President. Walz vocally supported those progressive changes and signed them into law. Therefore, it would be fair for him to tout them in early Democratic primary states.

But Klobuchar and Walz aren’t going to be in those states, not as candidates anyway. They have enough political sense to understand that they’re never going to defeat an accomplished, albeit ancient, incumbent, and that trying to do so at this late hour would irreparably ruin their reputation with the leaders and activists they need in order to be effective.

Phillips, for all his strengths, appears incapable of understanding that part.