President Donald Trump is coming to Minnesota today. That means we’ll be treated to lots of bullying of Representative Ilhan Omar, crowing about the “exoneration” that the Special Counsel specifically has said was not an exoneration, and vilifying of families fleeing desperate conditions for a better life in America.

President Donald Trump is coming to Minnesota today. That means we’ll be treated to lots of bullying of Representative Ilhan Omar, crowing about the “exoneration” that the Special Counsel specifically has said was not an exoneration, and vilifying of families fleeing desperate conditions for a better life in America.

And you thought there was a cold wind blowing into Minnesota last week?

Since it’s Tax Day, we’ll also be hearing lots of bragging from the President about his tax cut law. But you probably won’t hear him mention that his tax law, which was dutifully supported by every Republican in the Minnesota congressional delegation, led to twice as many corporations paying $0 in taxes compared to the period before the Trump tax cuts. Here is an excerpt from an NBC analysis.

At least 60 companies reported that their 2018 federal tax rates amounted to effectively zero, or even less than zero…according to an analysis released today by the Washington, D.C.-based think tank, the Institute on Taxation and Economic Policy (ITEP). The number is more than twice as many as ITEP found roughly, per year, on average in an earlier, multi-year analysis before the new tax law went into effect.

Among them are household names like technology giant Amazon.com Inc. and entertainment streaming service Netflix Inc., in addition to global oil giant Chevron Corp., pharmaceutical manufacturer Eli Lilly and Co., and farming and commercial equipment manufacturer Deere & Co.

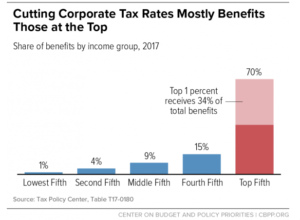

“Instead of paying $16.4 billion in taxes, as the new 21 percent corporate tax rate requires, these companies enjoyed a net corporate tax rebate of $4.3 billion, blowing a $20.7 billion hole in the federal budget last year.”

“The specter of big corporations avoiding all income taxes on billions in profits sends a strong and corrosive signal to Americans: that the tax system is stacked against them, in favor of corporations and the wealthiest Americans,” Gardner wrote in the report.”

The next time you hear Trump or other Republicans say there isn’t enough money to help seniors, children, disaster victims, patients, farmers, disabled people, veterans, students, parents, and dislocated workers, remember this report and these lavish corporate handouts that are blowing an enormous hole in the federal budget.

I’m pretty sure “and we doubled the number of corporations paying zero taxes” is not likely to be an applause line that we will hear from President Trump at today’s Minnesota Tax Day rally. So I thought I’d do the President a favor and promote that particular accomplishment here.

Yesterday, Minnesota House Republicans–following the lead of President Trump and congressional supporters like Representatives Lewis, Emmer and Paulsen–

Yesterday, Minnesota House Republicans–following the lead of President Trump and congressional supporters like Representatives Lewis, Emmer and Paulsen–