I’m a big fan of Governor Walz’s proposal to give Minnesotans a new MinnesotaCare (MNCare) buy-in option. If it passes, it would be a signature part of his legacy as Governor. But he has a lot of work to do before he gets it passed, and he should start by wiping the slate clean and dropping the name “ONECare.”

To be clear, the name ONECare is hardly the biggest problem Walz faces. The much bigger problem is an army of well-connected health care lobbyists and industry-employed donors pushing legislators to stick with a status quo that reimburses the industry at higher rates than MinnesotaCare, an argument that legislators who are serious about cost-containment must reject.

To pass this proposal, the Governor is going to need to use his political capital and get a lot more personally engaged in the fight than he has been so far.

But the name ONECare certainly doesn’t help the cause, a cause I’ve been supporting over and over, and it’s easy and painless to fix.

When selling ideas and policies, words matter a lot. Think “estate tax” versus “death tax.” “Tort reform” versus “lawsuit abuse reform.” “Medicare-for-all” versus “single payer.” We’ve seen it over and over: Words impact clarity and emotions, and clarity and emotions impact voting behavior.

For three primary reasons, the brand ONECare doesn’t help Walz to convince anyone to enact perhaps the most important policy proposal on his agenda, and instead inadvertently hurts it a bit.

ONECare DOESN’T DESCRIBE, OR DISARM MOST DAMAGING CRITICISM. I prefer the very boring, literal name “MinnesotaCare buy-in option.” I know, I know, it obviously isn’t very lyrical or concise, but it instantly explains the patient benefit, and that’s the most important advocacy need.

This is a concept that almost no one understands, so they need a concise description. ONEcare is not the least bit descriptive. If a Minnesotan heard ONECare come up in a shorthand way, they would have no idea what is being discussed, and very likely would assume you were talking about a corporate health plan.

After 27 years in existence, “Minnesota Care” has a bit of brand equity, and “buy-in option” explains the concept much more clearly than “ONEcare.”

Even more importantly, “MNCare buy-in option” also shines a bright spotlight on that key word “option.” The word “option” disarms the most potent critique of the proposal, the false claim that Minnesotans will be forced to use “government-run health care” against their will.

In a year when Medicare-for-All is being lambasted on the national stage for being mandatory and coercive, it’s critically important to be repeatedly stressing the disarming key message that this is merely another “option” for Minnesotans to take or leave. Stressing that selling point in the name is the best way to achieve that kind of repetition.

ONECare SOUNDS VERY CORPORATE, WHEN IT’S THE ANTITHESIS OF CORPORATE. Also, ONEcare sounds very much like a corporate health care brand. In fact, if you search the internet for “onecare,” numerous private health ventures pop up.

Adopting a corporate-sounding brand name confuses and sullies an initiative that’s actually all about providing an option for relief from corporate insurance. That makes no sense.

ONECare IS TOO WALZ-CENTRIC AND PARTISAN IN TONE. Finally, ONEcare politicizes the proposal by using a derivative of Walz’s 2018 campaign theme “One Minnesota.” ONEcare comes across like a partisan advertisement, as opposed to a sincere effort to help Minnesotans get cheaper and better health care coverage.

Governor Walz likely intended ONEcare to be unifying – “we’re ‘one Minnesota’ and this gives everyone the same option in all parts of the state, including areas where there are few options.” I get that. But the fact that the “One Minnesota” sloganeering was so central to Walz’s recent election campaign makes ONEplan feel like it belongs to one political tribe only, instead of something that people of all political stripes should support.

Again, dropping the ONECare name obviously isn’t going to guarantee passage. For that to happen, legislators are going to need to have more courage, and Governor Walz is going to need to really use his political capital to fight for this. But dropping “ONECare” will help make their explanation of this excellent idea feel a bit more clear, direct, disarming, and apolitical.

As we count down Mark Dayton’s final days as Governor of Minnesota, it’s worth reflecting on one of the more peculiar figures in recent Minnesota political history.

As we count down Mark Dayton’s final days as Governor of Minnesota, it’s worth reflecting on one of the more peculiar figures in recent Minnesota political history. Minnesota gubernatorial candidate Jeff Johnson (R-Plymouth) is crying foul over an Alliance for Better Minnesota television

Minnesota gubernatorial candidate Jeff Johnson (R-Plymouth) is crying foul over an Alliance for Better Minnesota television  The coverage in

The coverage in

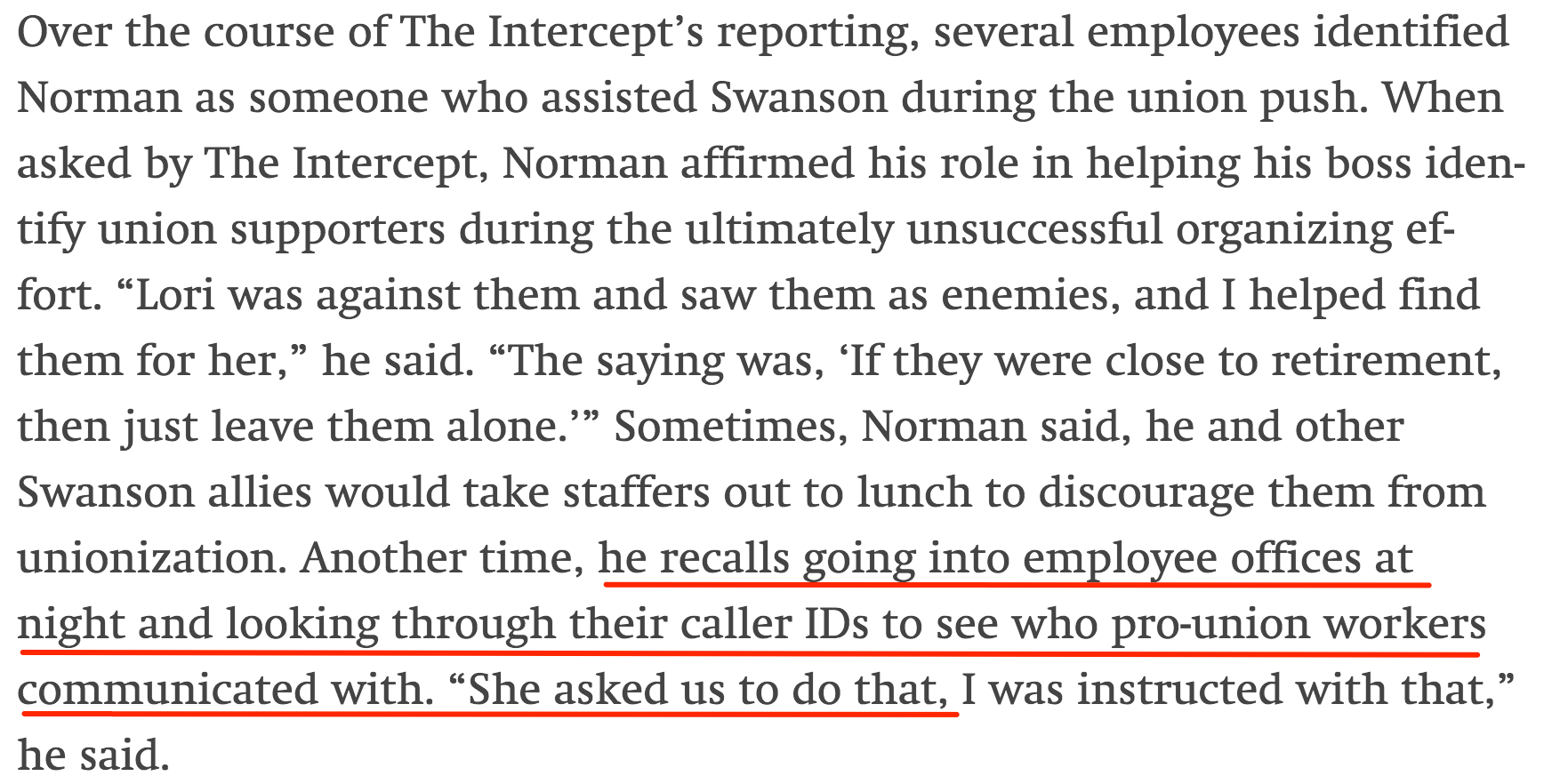

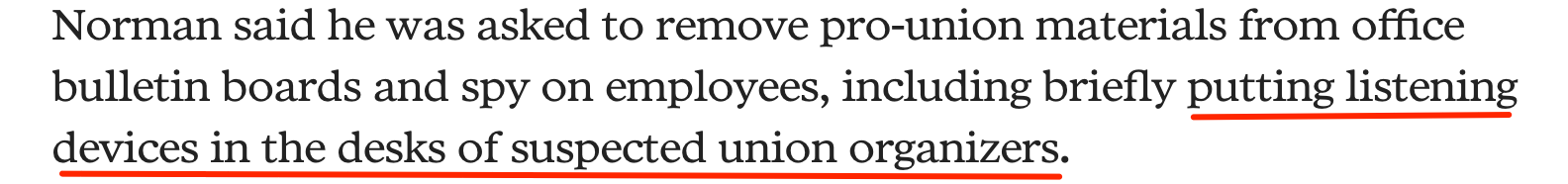

Wait, what? A guy who work worked at Lori Swanson’s side for years says he was wiretapping employees at Swanson’s behest, presumably so Swanson could retaliate against them? I’ll leave it to others to determine whether this kind of alleged spying on employees is illegal, but it certainly is, if true, supremely creepy and unethical.

Wait, what? A guy who work worked at Lori Swanson’s side for years says he was wiretapping employees at Swanson’s behest, presumably so Swanson could retaliate against them? I’ll leave it to others to determine whether this kind of alleged spying on employees is illegal, but it certainly is, if true, supremely creepy and unethical. Exuberant Minnesota Republicans seem to think they have a winning health care issue for the 2018 election season–reinsurance. And they do deserve a great deal of credit for helping to enact a state reinsurance program that is reducing premiums for Minnesotans in the individual market. The individual market is for the 162,000 Minnesotans who can’t get insurance from their employer or the government.

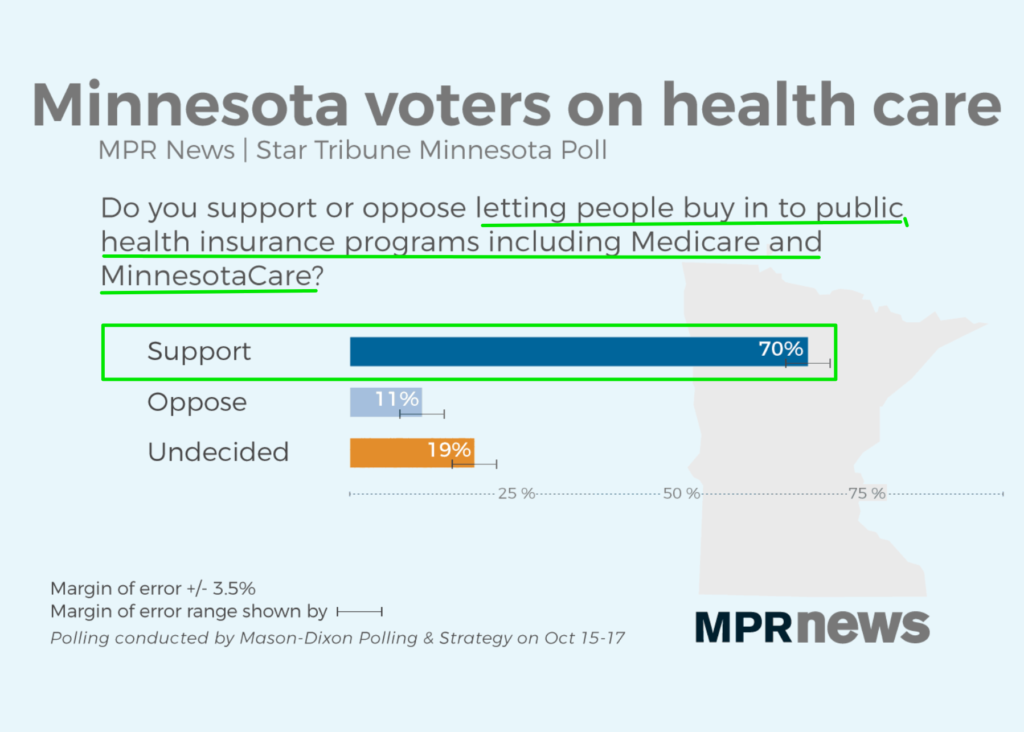

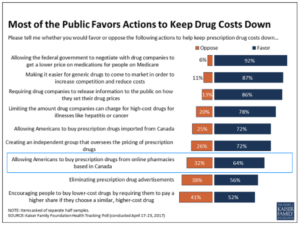

Exuberant Minnesota Republicans seem to think they have a winning health care issue for the 2018 election season–reinsurance. And they do deserve a great deal of credit for helping to enact a state reinsurance program that is reducing premiums for Minnesotans in the individual market. The individual market is for the 162,000 Minnesotans who can’t get insurance from their employer or the government. Nearly two-thirds of Americans like this idea. By an overwhelming two-to-one margin, a Kaiser Family Foundation

Nearly two-thirds of Americans like this idea. By an overwhelming two-to-one margin, a Kaiser Family Foundation  Who is that gallant knight

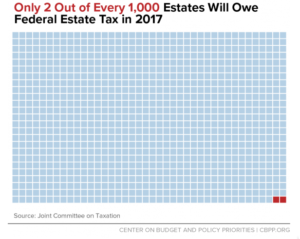

Who is that gallant knight  In the first year that Minnesota Republicans took full control of the Minnesota Legislature, they elevated Minnesota’s millionaire heirs and heiresses to the very top of their fiscal priority list. Representative Greg Davids (R-Preston) says the wealthiest Minnesotans should be able to “keep more of what their mothers and fathers and grandfathers and grandmothers have earned,” so Republicans significantly increased the’ estate tax exemption for millionaires.

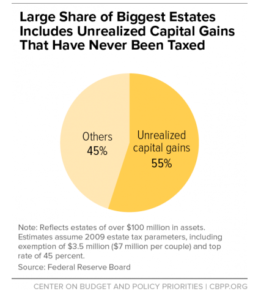

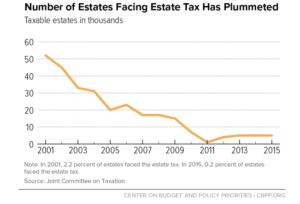

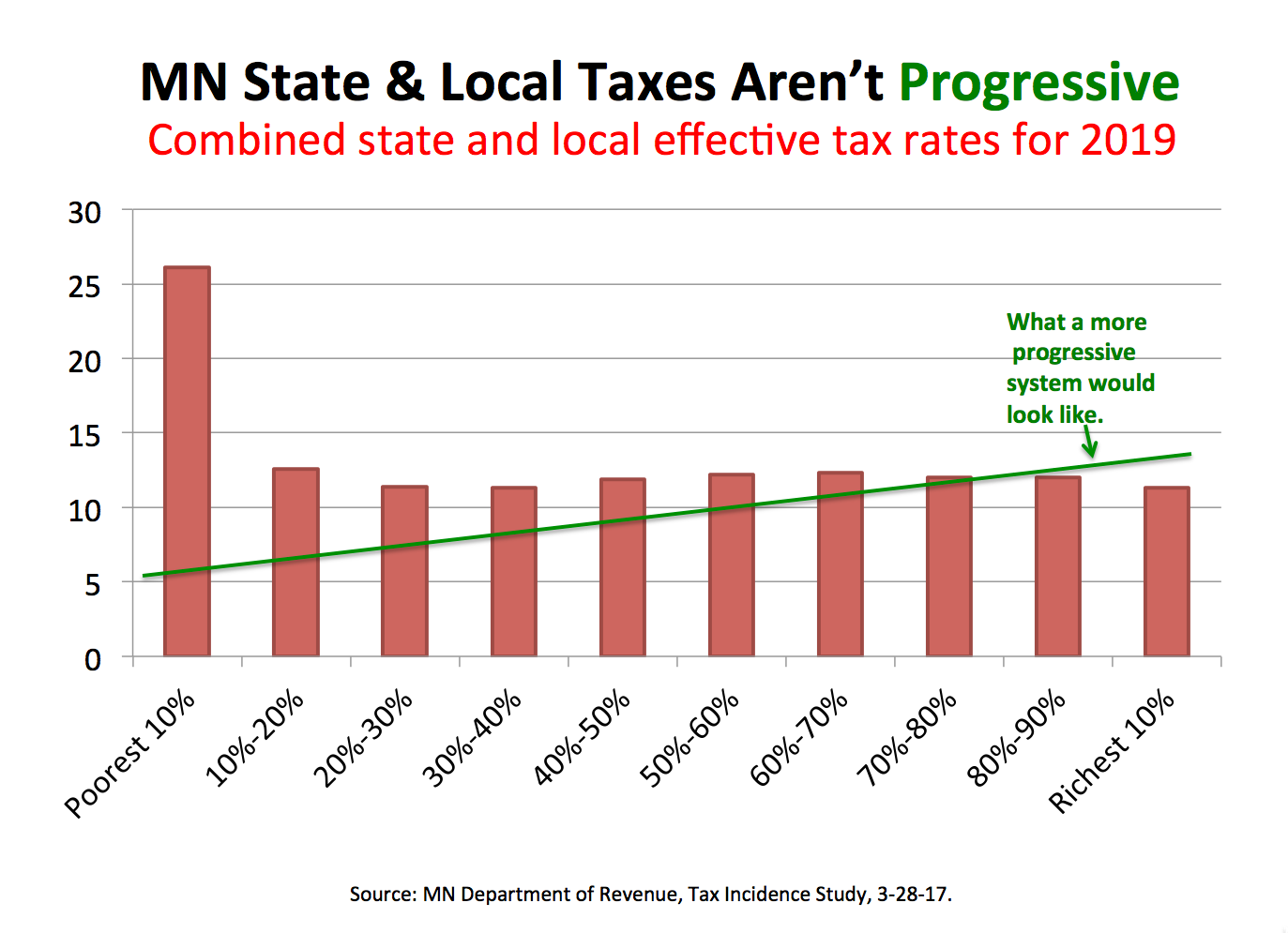

In the first year that Minnesota Republicans took full control of the Minnesota Legislature, they elevated Minnesota’s millionaire heirs and heiresses to the very top of their fiscal priority list. Representative Greg Davids (R-Preston) says the wealthiest Minnesotans should be able to “keep more of what their mothers and fathers and grandfathers and grandmothers have earned,” so Republicans significantly increased the’ estate tax exemption for millionaires. This is how intergenerational privilege perpetuates: Millionaire heirs and heiresses – having done nothing more than winning the birth lottery by being born into a wealthy family — are exempted from taxation, including for wealth that has already avoided taxation because it is

This is how intergenerational privilege perpetuates: Millionaire heirs and heiresses – having done nothing more than winning the birth lottery by being born into a wealthy family — are exempted from taxation, including for wealth that has already avoided taxation because it is  While today’s Republican Tea Partiers don Revolutionary War-era tri-corner hats while asserting that the estate tax is “Marxist,” the truth is that the estate tax has been strongly supported by a number of founding fathers.

While today’s Republican Tea Partiers don Revolutionary War-era tri-corner hats while asserting that the estate tax is “Marxist,” the truth is that the estate tax has been strongly supported by a number of founding fathers. In 2018, progressive Governor Mark Dayton will be retiring, and Minnesota voters will be selecting a new chief executive. To retain control of the Governor’s office in 2018, Minnesota Democrats need a compelling policy agenda. It goes without saying that they also need a compelling candidate, but this discussion is about policy.

In 2018, progressive Governor Mark Dayton will be retiring, and Minnesota voters will be selecting a new chief executive. To retain control of the Governor’s office in 2018, Minnesota Democrats need a compelling policy agenda. It goes without saying that they also need a compelling candidate, but this discussion is about policy.

As the 2017 Minnesota legislative session heads into the home stretch and President Trump is

As the 2017 Minnesota legislative session heads into the home stretch and President Trump is  Not Feeling The Mandate. Trump mandate? What mandate? Most Minnesotans don’t like Trump’s policies any better than they like him personally. About two-thirds (

Not Feeling The Mandate. Trump mandate? What mandate? Most Minnesotans don’t like Trump’s policies any better than they like him personally. About two-thirds ( Okay With O’Care. Then there is Obamacare. Republicans seem supremely confident that Obamacare is wildly unpopular. But a narrow plurality of Minnesotans actually is okay with it.

Okay With O’Care. Then there is Obamacare. Republicans seem supremely confident that Obamacare is wildly unpopular. But a narrow plurality of Minnesotans actually is okay with it.  Republicans — ever eager to show they are in touch with the values of ordinary Minnesotans — are very fond of drawing analogies between household budgeting and government budgeting. Former Governor Tim Pawlenty was especially keen on talking about the virtues of “kitchen table budgeting.”

Republicans — ever eager to show they are in touch with the values of ordinary Minnesotans — are very fond of drawing analogies between household budgeting and government budgeting. Former Governor Tim Pawlenty was especially keen on talking about the virtues of “kitchen table budgeting.” More to the point, families typically don’t cut the family budget — across the board or otherwise — when the family finances are stable or improving. I promise you, this is not heard at very many kitchen tables: “Okay sweetie, we’re financially comfortable and stable right now, but let’s cut the household budget deeply anyway!”

More to the point, families typically don’t cut the family budget — across the board or otherwise — when the family finances are stable or improving. I promise you, this is not heard at very many kitchen tables: “Okay sweetie, we’re financially comfortable and stable right now, but let’s cut the household budget deeply anyway!” A steady stream of candidates for the 2018 gubernatorial race will soon be emerging. Often “past is prologue” in politics, so we might want to consider the type of leader Minnesotans have preferred in our recent past.

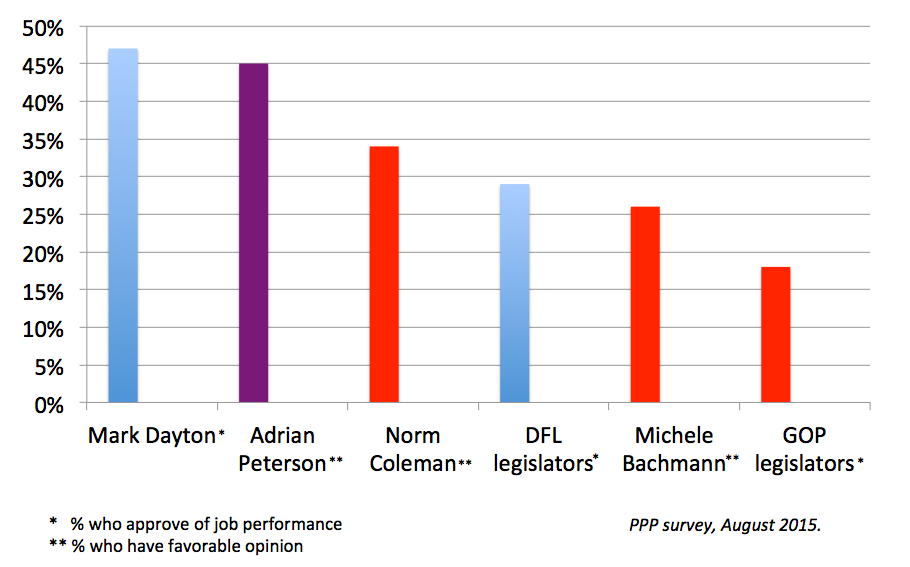

A steady stream of candidates for the 2018 gubernatorial race will soon be emerging. Often “past is prologue” in politics, so we might want to consider the type of leader Minnesotans have preferred in our recent past.