Minnesota’s Social Security recipients don’t have bills for child care, which for infants in the Twin Cities metropolitan area child care center are averaging about $18,000 per year.

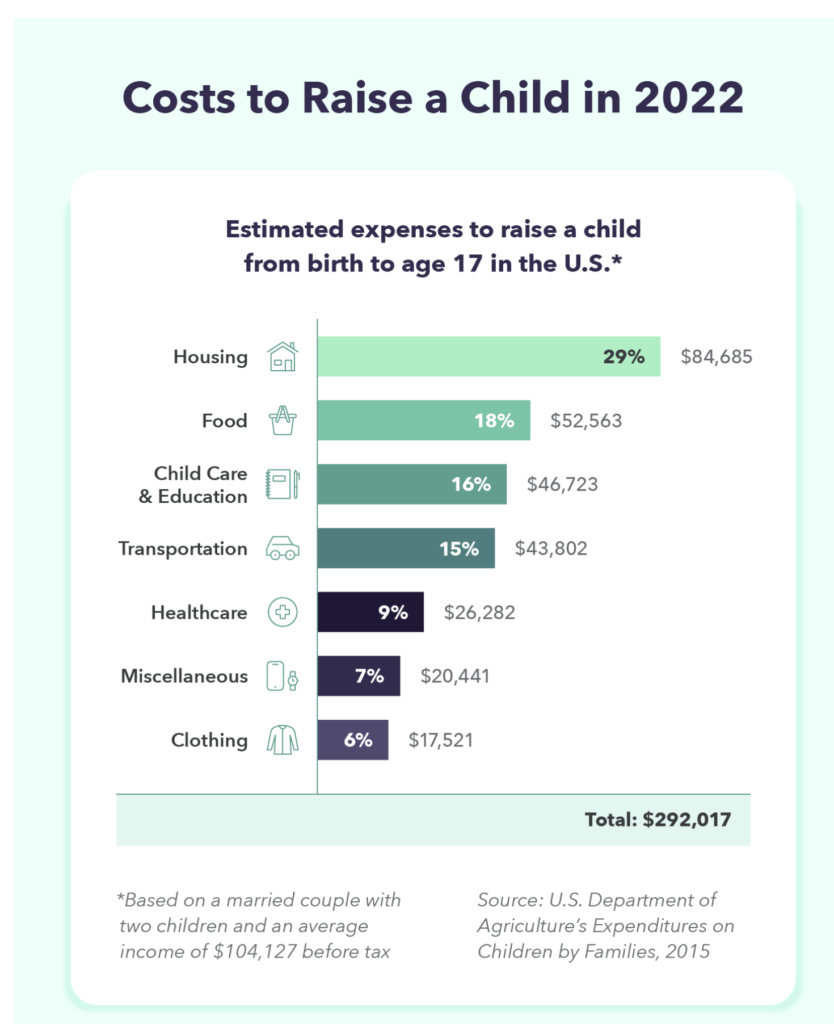

Most retirees no longer have to pay any of the costs for raising children, which averages about $233,610 per child, according to the U.S. Department of Agriculture (USDA).

Oh and by the way, that USDA figure is only until age 17. After that, many families face massive bills for public college tuition, books, and housing bills, which are averaging about $17,606 per year, per child. That expense is also in the rearview mirror of Social Security beneficiaries.

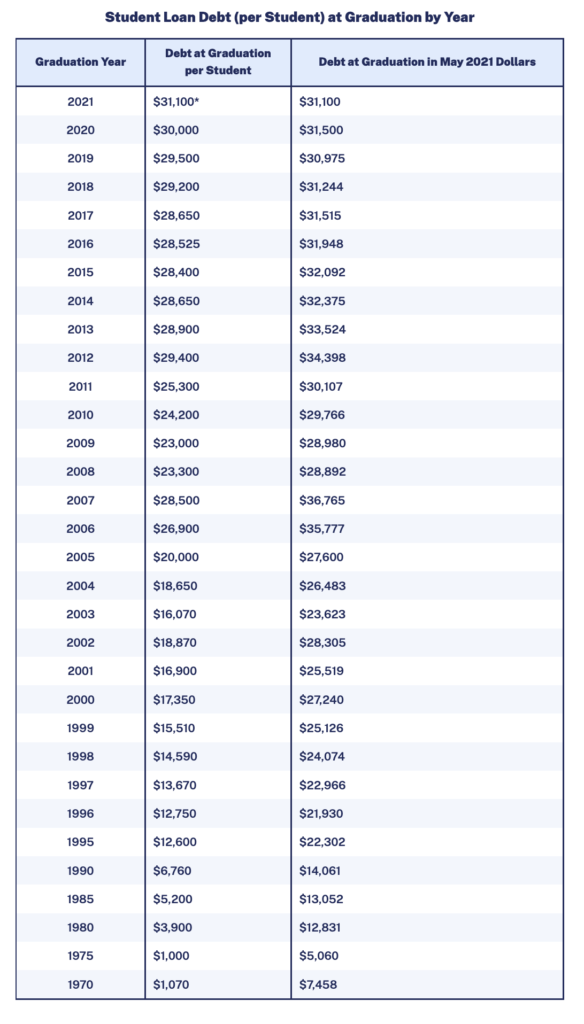

Keep in mind that many in this generation of young families facing those daunting expenses are also starting off life with huge student loan bills that dwarf what today’s retirees paid.

In the face of these figures showing the crushing expenses facing Minnesota’s young families, the Minnesota Legislature is fixated on a large $510 million tax cut for Social Security recipients.

As MinnPost explains, that cut won’t be helping the neediest Social Security beneficiaries. Low-income Minnesota retirees already pay no taxes on their benefits, as do many middle-income retirees.

Right now, about 55 percent of the roughly 400,000 people who receive Social Security in Minnesota don’t pay taxes on the benefits. The bulk of the elimination would help taxpayers who have $100,000 or more in total income, according to a Senate analysis.

That Senate research found people with incomes between $50,000 and $75,000 a year would save an average of $733 per year. Those making more than $500,000 would save $2,397.

So why is the Minnesota Legislature considering putting the state’s wealthiest Social Security recipients at the top of its gift list? Because wealthy retirees need the help more than young families in their heaviest spending years? Nope.

Because retirees vote. According to U.S. News and World Report, in 2018 voter turnout for 18 to 24-year-olds was 30%. For voters over 65, turnout was more than twice as high at 64%. Politicians who want to hold on to power are all too aware of this fact. That’s a terrific political argument, but it’s a terrible equity argument.

If the Minnesota Legislature can find a way to finance universally accessible quality child care, adequate k-12 education funding, paid family and medical leave, low-income housing to address the homelessness crisis, enough food to help all hungry children, and significant public college tuition relief, maybe it can then find enough to help some more middle-income retirees. Maybe. But can we at least require Minnesota’s wealthiest Social Security recipients to pay their fair share for helping struggling young families and children?

Thank you for this, Joe! We’re retired and agree with you 100 percent!

Thanks for the support! I’m not far behind you on the retirement front, Lynell. But there’s a huge generational equity issue here.

Joe,

While you make some valid points for some seniors, you might want to consider, some of the seniors in their 60’s are writing checks for help for their parents in their 80’s. They also have large uncovered expenses if one partner or spouse has medical issues and additional help is needed, ditto those same parents in their 80’s. Those costs get huge. They are helping with these student loans, providing child care for family. Paying large out of pocket prescription bills not covered by drug treatment plans. The bank of grandma and grand pa is alive and well for many families. I know of very few seniors in the under a $100,000 category that aren’t helping family. It’s not all sunshine and lollipops for seniors. More out of pocket than you can imagine. If I was in the over $500K group I’d be embarrassed not to pay more taxes or help family more.

Thanks for your thoughtful comment. To be clear, I’m not saying higher-income seniors should never be helped. I’m saying that when resources are limited, wealthier seniors like me shouldn’t be at the front of the Legislature’s funding line.

I’m saying relatively wealthy seniors like me shouldn’t be ahead of low-income kids who are unable to access quality child care, homeless and hungry kids, young adults with education debts much larger than what my generation had, etc.

This doesn’t mean that wealthier seniors like me don’t face challenges. Of course we do. It just means that we don’t have challenges that are as large as today’s lower-income young people face.

Re housing, we had 17% mortgages, the start of the temp jobs, the right sizing of companies and mass layoffs, plenty of boomers with worthless degrees. Being drafted, no generation gets by unscathed. It just makes for news to be the most tragically afflicted generation.

Thanks for this column, Joe. The Minnesota Budget Project has long advocated against untargeted tax cuts on Social Security income. The reasons include the fact that both federal and state tax laws already provide tax exemptions for Social Security benefits that prioritize lower- and modest-income seniors.

Under federal tax laws, the lowest-income folks don’t pay any federal income taxes on their Social Security benefits, and everyone has some of their Social Security benefits exempt. Minnesota follows this practice and adds additional exemptions targeted by income. The cumulative result is that about two-thirds of Social Security benefits going to Minnesota residents is already exempt from state income taxes.

And importantly, a $500 million (and growing) annual cut to state revenues would ultimately undermine policymakers’ ability to invest in things that support lower-income seniors and the young families you mention in your column.

Thanks for the comment, Laura. I hadn’t heard that statistic about “two-thirds of Social Security benefits going to Minnesota residents is already exempt from state income taxes.” That’s important to understand.

It’s also important to remember that even among the wealthiest one-third of Minnesota taxpayers, a chunk of their benefits are already exempt from state income taxes. They’re not paying state income taxes on all of their benefits.

I really appreciate the stellar work that the Minnesota Budget Project/Minnesota Council for Nonprofits does to bring analysis, insight, and transparency to these kinds of state budget debates.

BAH! HUMBUG! my wife and i are both in our 70s. only income is SS and pension from our unions. adds up to a little more than 100K a year. every month, after we pay the bills, there’s little left to say, take a vacation, or go south for the winter. not being taxed on SS might provide a little more cushion every month. by the way, we raised two kids, put them thru private schools (because LA public schools are bad) and paid for their college, but needed student loans. But we were both working then and we could afford it. on what we get yearly now, we couldn’t do it. when i was at UCLA in the 70s I remember my tuition was 600 dollars a year. A YEAR! that right there is the problem! what happened to make higher learning so damn expensive. paying a football coach 7 million a year?! until covid, I also made some additional income being an assoc. professor at a university in san francisco and another in st paul. if that was your only source of income you couldn’t sustain a life on what they paid. so, where is all the money going?

As with all equity issues, there needs to be more public education. I think most MN seniors want younger generations and specifically young families to succeed but “well back when I was your age” thinking is alive and well. The pace of change over my 50 plus years has been accelerated such that the incrementalism of our governance along with the dysfunction of hyper partisanship has meant that public policy and infrastructure has not kept pace to meet the needs of our most systems dependent residents like young families, those with low incomes and others. Assumptions about the kind of supports past generations received no longer hold true; beyond policy not keeping pace, the pandemic and other historical events have fundamentally changed systems in ways we’re discovering daily. It’s clear from research and anecdote that we are all more insular in our daily toils and views. While I was able to roll my student loans into the purchase of my house 30 years ago, that’s not an option for my young adult kids so a major financial liability can no longer become a potential asset. This is on top of the speculation that has destabilized the housing market many of us used as a stable wealth building vehicle. I would not have attended college (or grad school) if I would have needed to incur the $50K-$100K in debt my middle class kids now carry to get an under graduate education required to enter the job markets they’ve been taught will provide at least the life they had growing up. As a family with a widely impacting congenital disorder that has relied on public support for extreme medical care, the asset limits placed on us in order to get that support meant saving for college was not an option. And so it goes. There are many variations on the theme of families ‘following the rules’ but finding dead ends at crucial points because policy has not kept pace with it’s own intentions nor initial plans. Heck, you can go back to Reagan’s dumping child survivors off SS support abruptly in the 80’s and see how that both exemplifies the march to curb public support for families and how it has diminished the financial prospects (and long term sector growth) for many young families. It’s been a decades long process of shifting societal supports away from families toward business, which now receive almost the same level of government welfare once directed at individuals and families pre 1980’s. Many of the seniors now on SS enjoyed benefits and fringe compensation form years of employment that no longer exist for workers after Gen X. There is an actual age divide with a landscape shaped by policy decisions of yore compounded by the dysfunction and inaction of late. Until both sides of that divide understand challenges driving needs for systemic supports, little will be accomplished addressing it.

Great examples, Anita. Thanks.

I agree, Joe. Bottom line: Income is income, and it should all be taxed at the same graduated rates. No special treatment for Social Security, no special treatment for capital gains, etc. I still think that the best tax reform that was ever done was the Bradley-Gephardt simplification effort.

Well said. Income is income. Income for the electorally powerful shouldn’t get a loophole.

Here is a good, recent article on this general phenomena:

https://www.vox.com/the-goods/2023/1/4/23413342/us-tax-havens-billionaires-wealthy

And, yes, exempting Social Security income from taxes is a tax cut to the rich, largely at the expense of the poor.

Outstanding piece, Joe. Those of us with large, guaranteed incomes and affordable high-quality socialized medicine don’t need further help from our governments.

Thanks, Dane!

You’re a learned student of the Legislature. What’s your best guess of the outcome? Will the DFL majority keep taxing the SS income of say the top 5%?