There is a lot to dislike about the Minnesota Republicans’ tax cuts that were recently signed into law. For instance, increasing the estate tax exemption from $2 million to $3 million is an unnecessarily lavish gift to about 1,000 Minnesotans who won the birth lottery by being born into a relatively wealthy family. Overall, the Republicans’ tax cuts will compromise Minnesota’s future fiscal stability by reducing state revenue by more than $5 billion over the coming decade. This is a particularly reckless move at a time when President Trump and his Republican congressional supporters are proposing to shift billions of dollars in future costs to states. The next time Minnesota has a budget shortfall, remember the Republicans’ 2017 tax cuts.

But the stinkiest of the Republicans’ tax cut stink bombs was their tobacco tax cut, because in the coming years it will cause suffering and death.

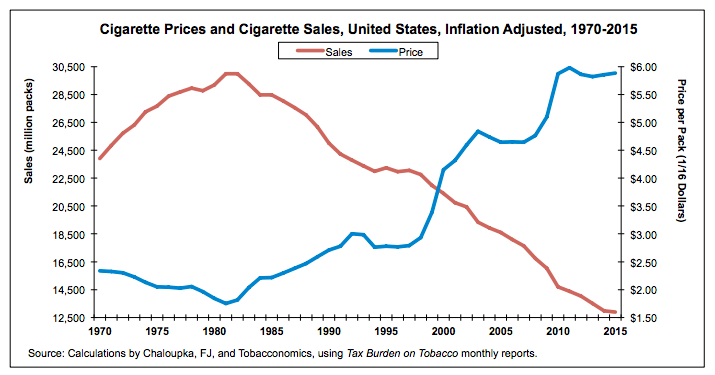

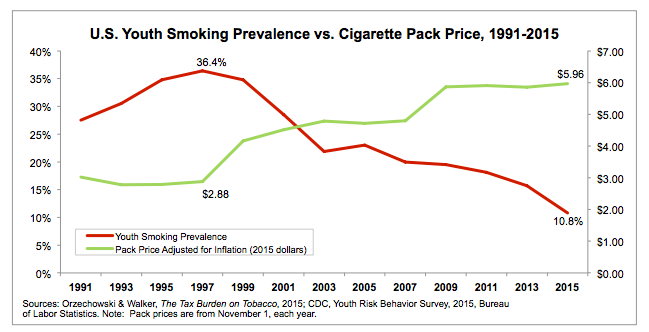

Think that’s hyperbole? A mountain of research shows that every time tobacco prices increase, tobacco consumption decreases. The corollary is also true – tobacco consumption increases when tobacco prices decrease.

This is particularly true when it comes to price-sensitive young Americans.

Here’s why that matters: When tobacco consumption increases, tobacco-related suffering and death increases. Though we don’t hear about it as much as we used to, tobacco use remains the leading cause of preventable diseases and death in America. It causes a variety of deadly cancers, lung diseases, and heart diseases, among other serious health problems. If you’ve ever seen anyone suffer from one of these illnesses, I promise you will never forget it.

If you don’t believe the legion of public health and economic researchers about tobacco taxes decreasing tobacco use, listen to the tobacco industry executives themselves. In a previously secret document that got disclosed during lawsuits, an executive from Philip Morris, the makers of Marlboro cigarettes, said:

“Of all the concerns, there is one – taxation – that alarms us the most. While marketing restrictions and public and passive smoking [restrictions] do depress volume, in our experience taxation depresses it much more severely.”

Likewise, an executive from RJ Reynolds, makers of Newport and Camel cigarettes, came to the same conclusion:

“If prices were 10% higher, 12-17 incidence [youth smoking] would be 11.9% lower.”

So if Republican legislators think their tobacco tax cut is doing a favor for Minnesota smokers, they couldn’t be more wrong.

Yes, financially speaking, the tobacco tax is regressive. That is, the higher costs of tobacco products that result from tobacco taxes disproportionately impact the pocketbooks of poorer Minnesotans.

But that’s not the end of the story, because the reduction in tobacco-related suffering and death that comes from higher tobacco taxes is progressive. That is, the life-saving health benefits associated with higher tobacco taxes disproportionately flow to poorer Minnesotans. And by the way, the millions of dollars in savings from not having to pay as much to treat those tobacco-related diseases flow to Minnesota taxpayers and health insurance premium payers.

The bottom line is that cutting tobacco taxes, as Minnesota Republicans did this year, has two major impacts. It causes tobacco executives to profit more from increased sales, and it causes our family members, friends, and neighbors to suffer tobacco-related diseases.

Therefore, when it comes to tobacco taxes, Minnesotan leaders have to be cash cruel to be clinically kind. If the DFL Party wins control of the Minnesota Legislature in 2018, increasing tobacco taxes must be at the very top of their agenda.